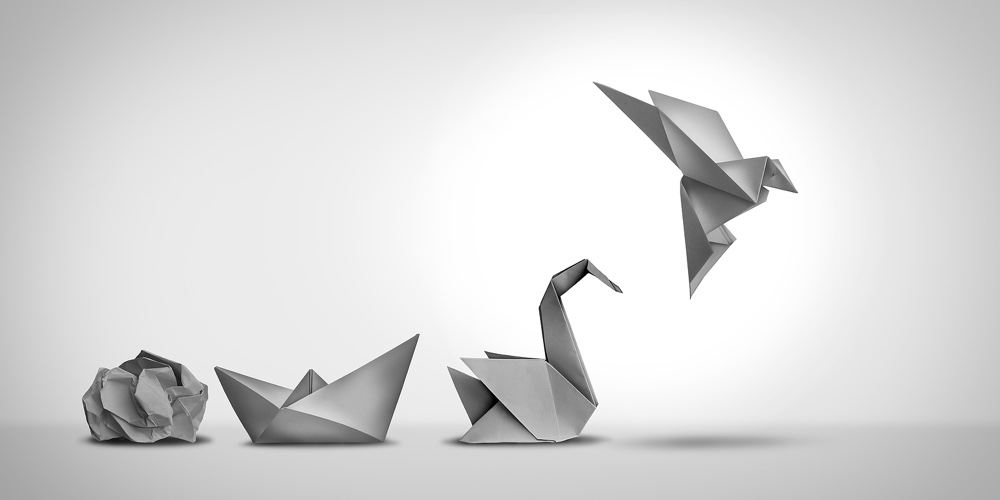

Evolution of consumer credit: How have consumer preferences changed?

The birth and expansion of consumer credit

The recent concept of consumer credit can be traced back to the early 1900s with the advent of the automobile, as consumers needed new ways to pay for large purchases. Credit cards gained popularity in the 1950s and 1960s; by the 1980s, they had become a staple in the wallets of most Americans.

In recent years, the rise of online shopping and mobile payments has further expanded the use of consumer credit. Today’s applicants can apply for and receive credit in minutes to make purchases online, in-store, or even through their mobile phones.

But perhaps more importantly, today’s applicants look for different features in their credit tools. They have higher expectations than before and reward credit counterparties with loyalty and performance.

The importance of technology and the rise of fintechs

Consumers have become accustomed to technology in all aspects of their lives, so they have increasingly turned to high-technology solutions for their finances.

Consumers today expect online interfaces and fast credit approval windows. Based on McKinsey & Company research, as much as 33% of global card spending – 50% in the US – now takes place online,1 with a large portion of small and midsize companies in the US relying on software solutions for managing their business.2 Borrowers also reward credit providers who make it easy to continue to engage with their products via a mobile app or other integrated services (such as loans with rewards or one-click refinance features).

In this context, fintech companies have emerged as increasingly meaningful players for consumers looking for new tools. Fintechs use advanced technology and automation to streamline their operations and operate primarily online, which can help reduce labor costs and other expenses. They pass these savings on to consumers through lower fees, lower interest rates, and the elimination or reduction of additional charges. This can make financial services more accessible and affordable for consumers, particularly those who may have been excluded from the traditional financial system due to higher costs.

Increased brand loyalty and consumer preferences

As alternative financial institutions and an array of credit products become more accessible through technology, consumers are more likely to see their interactions with financial service providers as a relationship rather than a transaction.

In addition to price, today’s consumers often consider other intangible factors when choosing a product or service. They may be willing to pay more for a product or service if they feel it provides a superior overall experience. These experience factors can include the quality of the product or service, the reputation of the company, customer service, and the perceived value of the product or service in meeting their needs or achieving a specific benefit.

One example: many of today’s consumers have high customer service expectations. Consumers want companies to know them and anticipate their needs, and they expect more customized offers that are tailored to their needs. This extends to financial service providers as well. A provider’s ability to execute on this consumer expectation is tied to its appropriate and intelligent use of data to determine what products and services a consumer might need and when, based on their behavior. For instance, a well-timed offer of credit made in anticipation of a consumer’s needs can enhance the relationship between a consumer and the financial institution.

Unique times, unique tools

Consumers also expect that their providers adapt to changing conditions.

Borrowers increasingly expect financial institutions to offer flexible solutions to meet their changing financial needs. For example, as natural disasters become more commonplace, consumers want their financial institutions to work with them and provide them with a lifeline. Hardship plans, which allow consumers to make reduced or delayed payments, can help prevent borrowers from falling behind on their bills or debts. Efficient consumer credit providers have increasingly looked to offering these flexible tools as hurricanes, earthquakes, floods, and wildfires have increased.

Lenders who offer solutions and work quickly to implement them show their willingness to work with consumers. This can help improve the relationship between the lender and borrower, and can help reduce the risk of default and other adverse outcomes for both parties.

The evolving future of consumer credit

Looking ahead, the future of consumer credit is likely to be shaped by several factors, including technological developments, changing consumer preferences, and regulatory changes.

As digital and online lending platforms continue to grow, the importance of big data and related technological advancements cannot be ignored. Big data plays an increasingly important role in the growth of fintech companies. These companies use advanced algorithms and data mining techniques to analyze large amounts of data to identify trends, predict customer behavior, and make more informed business decisions.

The future of consumer credit will also likely be influenced by regulatory changes. Governments worldwide are increasingly focusing on consumer protection in the financial sector, and they may introduce new rules or regulations to improve transparency and fairness in the credit market. This could impact how consumer credit is offered and used, and it could also have implications for the growth and competitiveness of the industry.

Over the past 100 years, consumer credit has changed dramatically; it will evolve even further over the next 100.