Credit union marketers want people to sign up for membership, apply for loans, and increase their deposits, because all three are essential for growth. That’s why your credit union wants to grow wallet share and be more than just a single account where someone parks a little extra money. The right chatbot can help people discover all the great services you offer, in a way that’s new and exciting.

Your credit union’s website is one of your most powerful marketing tools. Members go there several times per month to access online banking and nonmembers check out your site to get a sense of what you offer before they ever step into one of your branches. However, a great website is more than just a beautiful design and flawless copy. Great websites create engagement.

A set of five studies on GoodUI shows that gradual engagement increases conversion by 20%. In other words, if you design a website experience that invites users to engage just one little step at a time, then you’ll increase your online applications by 20%. And a chatbot can be a near-perfect example of gradual engagement.

When we think of chatbots, we usually think of incredibly complex AI that is almost like talking with another human. We think of Siri or Amazon Alexa who can respond to even the sassiest questions like, “Do you have a boyfriend?” Fortunately, an effective chatbot for your credit union website design can be a lot simpler than that.

Chatbot Examples

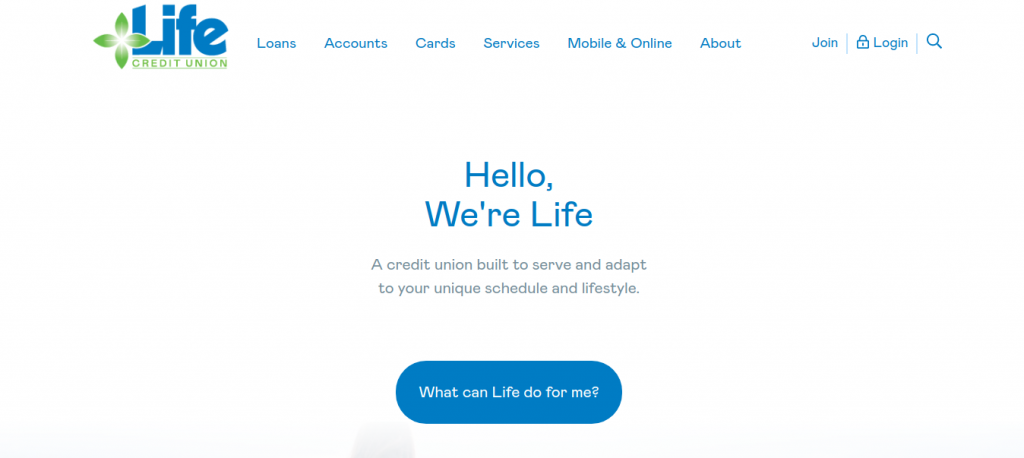

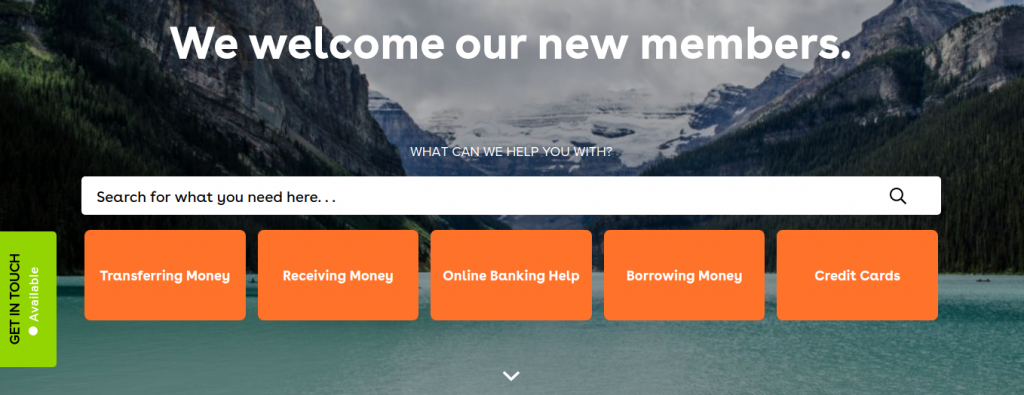

Here’s an example on the website we built for LifeCU.org

The chatbot begins by asking “What can Life do for me?” a simple question that attracts attention, without a too-intimidating CTA up front.

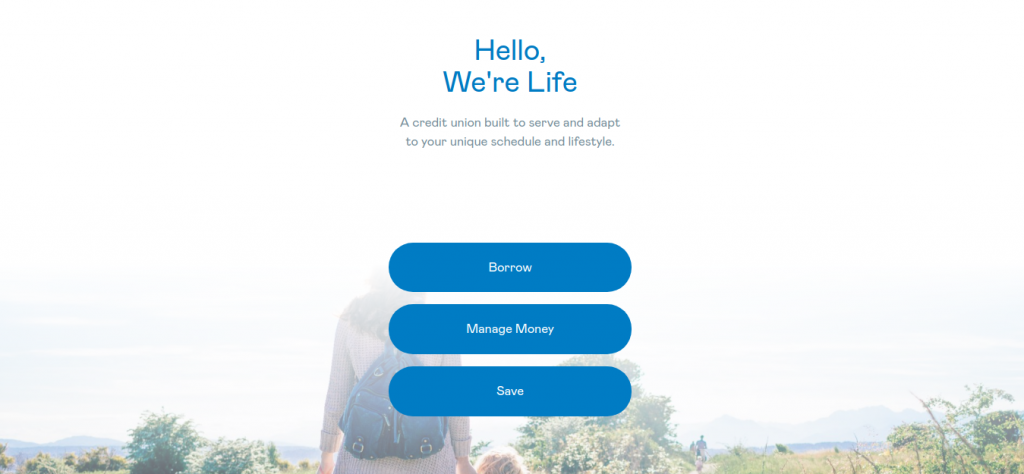

Next the chatbot offers categories for how it can help, categories broad enough that most site visitors would be interested in at least one of them.

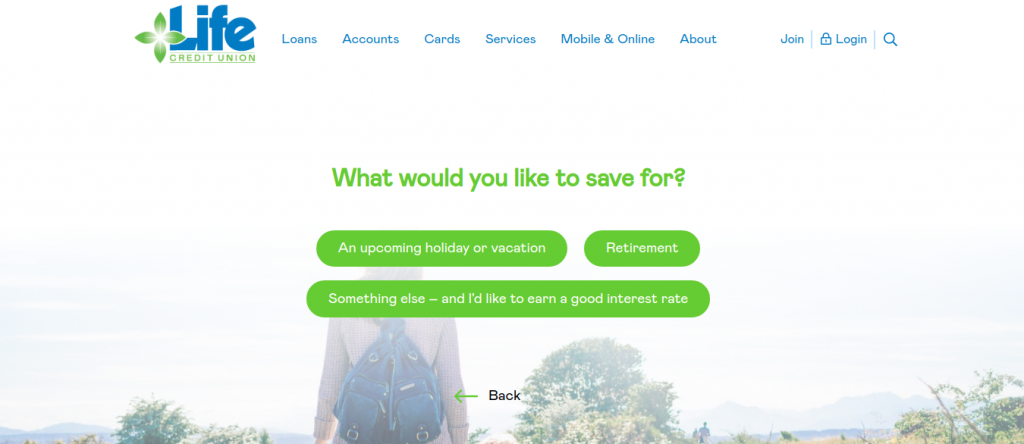

Let’s say the user picks “Save”. They then have more options for how Life CU can specifically help them save, whether it’s for vacation, retirement, or just that they want to maximize their potential interest.

Using Chatbots for Customer Service Issues

Chatbots can also be a powerful tool to reduce customer service build up. One credit union, OAS FCU, has a massive international member base. In order to accommodate their members, they offer just about every type of money transfer service under the sun, which also means they get a lot of different calls and emails for support. Members need to know what kinds of transfers are covered in their country of residence, what information they need to send transfers, and what methods they must use to send them.

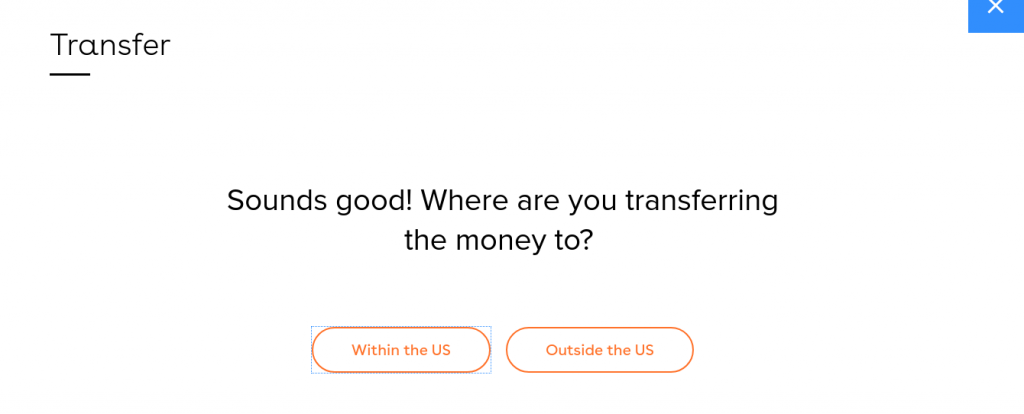

Enter the chatbot we built for OASFCU.org.

The chatbot guides the user through a series of easy to answer questions, such as “How much money do you need to transfer?” and “Where are you transferring money to?”

Based on the user’s answers, it then lets them know what type of transfer they need, and how to perform it. In most cases, the bot encourages them to use online banking for their transfer, which takes a significant burden off service reps.

Chatbots are a fantastic asset to any credit union website. When we redesigned the website for Penn East FCU, we updated their design and copy and also implemented several simple chatbots to help users get around and discover new products. While the chatbots on their site can’t take full responsibility, Penn East has seen a 4,200% increase in leads since we helped them launch a new website earlier this year.

As a marketer, you often think about how you can connect people with what they want (achieve goals, have more money to spend on things, etc.) to what your credit union offers (specific accounts, loans, and services). Chatbots can help you draw a line between those two dots, leading to greater interest in your products.

In yet another example, a chatbot we built for Spirit of Alaska FCU got engagement rates between 3-10% on their homepage. Compared to sliders (aka carousels or rotating banners) which usually get engagement of less than 1%, Spirit’s chatbot performed 3-10x better.

Recommended Resources

If you’d like to build your own chatbot, there are numerous softwares you can use. You could consider using Drift, Intercom, Hubspot, etc.

And, obviously, we at BloomCU have a chatbot made just for credit unions. It’s simple for users, easy to edit (doesn’t require any coding on your end), and engages people (most importantly).

Interested in more credit union website design insights and ideas? Get our award-winning insights.