How the pandemic is shaping the M&A landscape

Are we at a tipping point for credit unions? Proactive credit unions that have been performing well for a long period of time are starting to reconsider potential mergers and acquisitions for relevance, stability, scale and, most importantly, to benefit their members. The COVID-19 crisis and resulting economic uncertainty may usher in new opportunities for organizations to consider collaboration, especially those without strong digital infrastructure or drive-thru capabilities. Adapting has proven quite difficult for some organizations and simple for others as they streamline existing remote and contactless operations to serve their members.

Could your credit union be a white knight?

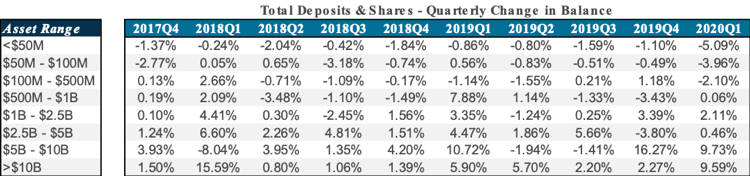

In general, larger institutions are better prepared to handle the ebbs and flows of economic uncertainty than smaller institutions. We can see this in the Q1 2020 data as every peer group over $500 million increased shares. For the $5 – 10 billion peer group, shares increased even more significantly by 9.73% on average, while peer groups under $500 million all saw declines in share growth.

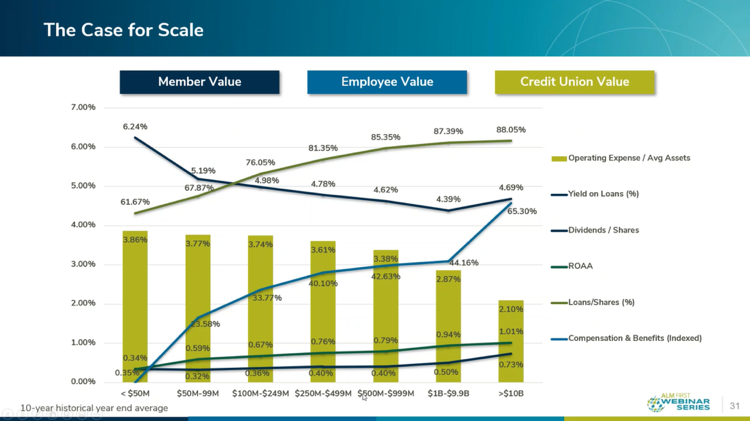

Bank deals have stalled because of declining valuations and uncertainty, but credit union deals are still being announced in 2020 and we expect this to continue. Your credit union may have an opportunity to be a “white knight” by helping a struggling credit union that is either lacking a strong digital infrastructure or being significantly impacted by the pandemic. The number of transactions may decline; however, some organizations are taking a proactive approach and new discussions are happening. The chart below shows why – as scale drives member, employee and credit union value.

Which trends are likely to continue?

While no one knows exactly what the recovery will look like, we do expect to continue to see higher loan loss provisions. We also expect to see lower net interest margins due to the substantial decline in interest rates and lower earnings throughout 2020.

Unlike the Great Recession, earnings are the primary issue for financial institutions—not capital as banks and credit unions entered COVID-19 with capital near record levels.

What are the challenges in exploring M&A opportunities now?

With so many working from home, it can be a challenge to contact key employees at potential targets and some institutions might put M&A strategy on hold because of more pressing issues related to the impact of COVID (internal operations, monitoring credit risk). However, credit union CEOs have been more receptive in the last several weeks now that credit unions are more comfortable with the “new norm.”

Regulatory pushback of completing a merger during COVID-19 may be a challenge as well, although trade associations have been pushing for more regulatory flexibility to address this. You may also find it more difficult to schedule meetings with the key stakeholders that are involved with a merger and face-to-face meetings, while ideal, may not be an option in the age of COVID.

Despite social distancing measures making negotiations more challenging, we have found that CEOs are more open to discuss merger possibilities than in past years and COVID-19 is the main driver. Larger institutions are considering targets that they might not have considered pre-COVID. Prior to COVID, smaller institutions (less than $200M) were primarily focused on mergers of smaller targets. Today, these organizations are more likely to be considering mergers of equals or even larger. The same is true for larger institutions ($1B+).

How will transaction volumes & timing be impacted?

Credit unions acquiring banks will mostly likely be delayed until 2021 and while credit union to credit union transactions will decline from 2019, we suspect deals will continue to be explored and completed.

COVID-19 has made some institutions realize that it might make sense to consider merging with another credit union to build scale. Bank to bank transactions will likely be limited and will probably only occur because of financial distress or as a matter of necessity.

We believe that M&A will become even more important for financial institutions once the economy recovers. COVID-19 has emphasized the importance of scale and deeper internal resources, especially in a low rate environment. Deals will increase once there is a better understanding of the credit risks.

Overall, the pandemic may make it more important to plan your M&A strategy now as a way to both proactively and reactively evaluate the changing environment for your credit union. Working with an experienced partner, such as ALM First, can provide the resources you need to evaluate these opportunities more effectively. Contact us today if you’d like to discuss the M&A environment and how we can assist your credit union in more detail.