How to tell the story of your credit union and win business

Branding is hard. For years, I’ve asked credit union marketers, “Why should I bank with you over any other financial institution?” At first, many have unattractive answers, but I’ve seen them go on to craft compelling brand messages by following a simple framework.

The Problem

If someone doesn’t see how you can help them survive or thrive, then they don’t care about your credit union. A brilliant marketer named Chuck Staib once taught me, “People buy benefits, and only benefits.” What he meant is that people only care about a product if they understand how it benefits them. In other words, people need to know, “What’s in it for me?”

Unfortunately, most credit unions don’t tell a clear story. As a result, they have a hard time attracting new members and borrowers. Unless a credit union learns how to communicate and deliver its value to consumers, it dwindles until it finally merges out of existence. In 1970, there were nearly 24,000 credit unions; today, fewer than 6,000 remain.

Some people might blame the marketing department if the credit union isn’t growing. Yet, the problem usually starts with the entire management team. Rarely can senior managers tell me what makes their credit union better or different from competitors.

Without consensus at the top, marketers get frustrated and confused because they can’t make up a value proposition from thin air. The rest of the credit union has to be on the same page in order to deliver value to members.

Use Frameworks to Communicate Clearly

As a marketer myself, communication frameworks have helped me create clear messages that win business. For instance, my company, BloomCU, is growing by 50-100 percent per year, and we’ve helped our clients grow, too. Like Katelyn McManamon, a marketer at Penn East FCU, who saw a 6,000% increase in online leads after working with us to launch a new credit union website design.

A good framework, rooted in psychology, takes the guesswork out of brand messaging by giving you a clear model. I’ve used a few frameworks over the years, and I want to share one that I’ll call The Story Framework (and I credit Donald Miller’s book Building a Story Brand for clearly laying out this framework). It shares many elements with other frameworks, but weaves all of the parts into a story.

The Story Framework

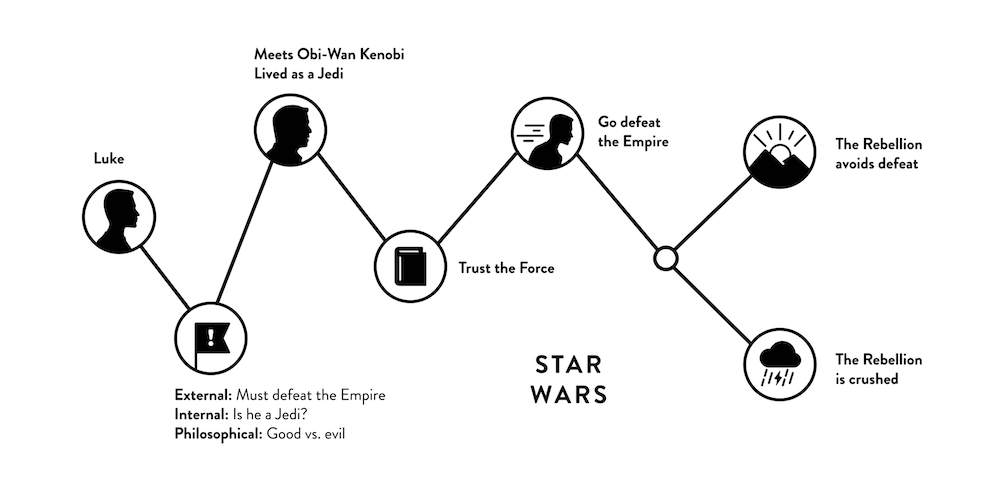

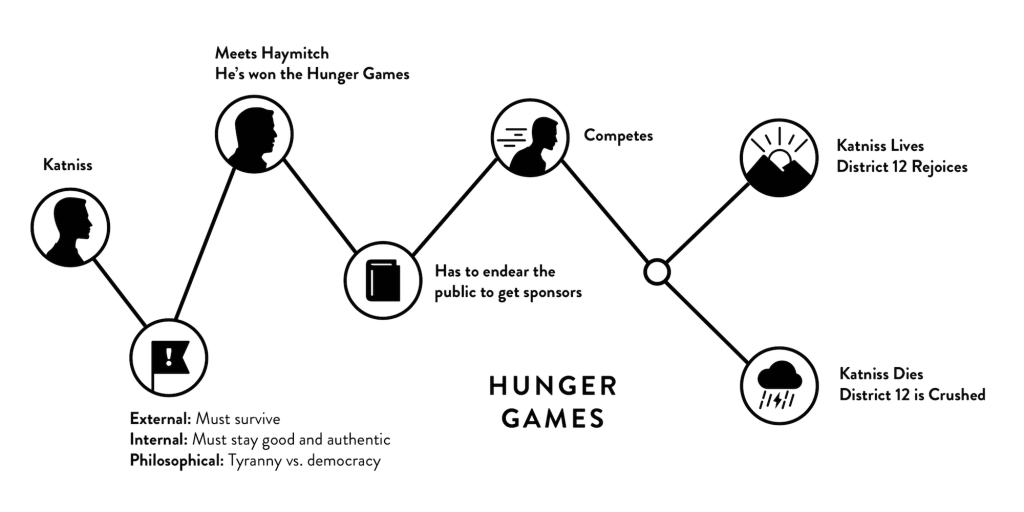

Stories are powerful—and memorable. Off the top of your head, you can probably summarize Star Wars IV: A New Hope (unless you’re one of those weirdos who has never watched it). The same goes for Hunger Games.

A summary of Hunger Games from StoryBrand.com

By telling the story of your brand, people can clearly see how they fit into it: they are the hero and your credit union is the guide who can help them live happily ever after.

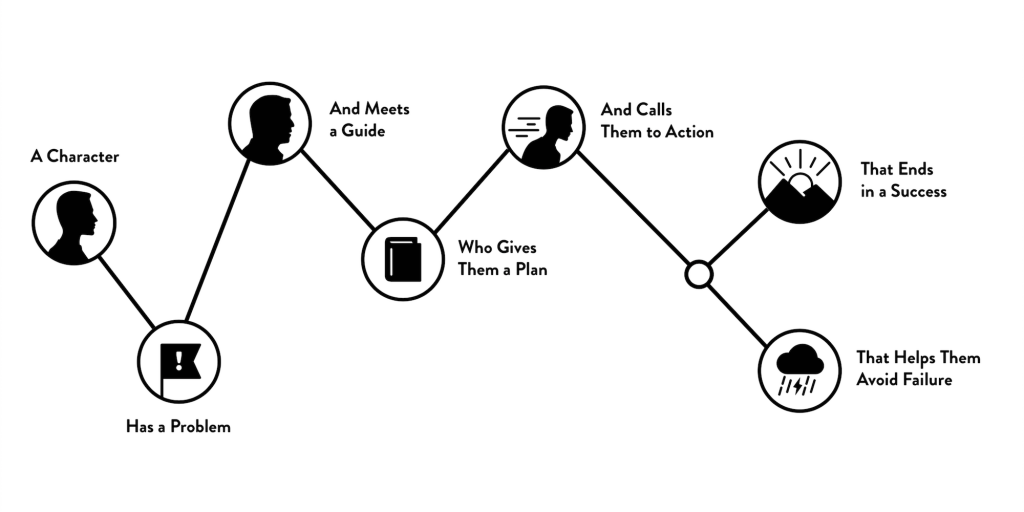

Let’s briefly look at the seven parts of The Story Framework.

Write your brand story in seven steps

1. A character. The main character (aka hero) of your story is your member or potential member.

2. Has a problem. What problem does your hero need to overcome?

Note: In most great stories, there is an External, Internal, and Philosophical problem—and they’re all tied together. In Star Wars, Luke must defeat the Empire (external), but he questions his ability to become a Jedi (internal) and overcome evil (philosophical: good vs evil). He conquers all three problems when he uses The Force to blow up the Death Star and save The Rebellion.

3. And meets a guide. In your brand story, your credit union is the guide, not the hero—the member is the hero. In other words, you are Luke’s Yoda or Frodo’s Gandalf. You are the wise tutor that leads people to financial success.

Note: To be trusted as a guide, you must have credibility. Remember when Luke first met Yoda and thought he was just an annoying, green pest? Yoda had to reveal his true identity as a Jedi master before Luke would trust him. With your credit union so it is. You’ll need to gather testimonials, examples, statistics, and success stories to prove that you provide real value to members.

4. Who gives them a plan. How can you help the hero solve financial problems and achieve success? What’s your plan?

Note: This is where you need to highlight how you are different or 10x better than your competitors.

5. And calls them to action. After you teach the hero your plan, you need to call them to action. What should they do now?

6. That ends in success. Paint a picture to show the hero what success looks like if they take action and follow your plan.

7. That helps them avoid failure. If the hero fails to follow your plan, what are the consequences?

More Examples of Stories Written with The Story Framework

You can use The Story Framework to help you organize your messaging for all types of marketing content. I even used it to outline this article before writing it:

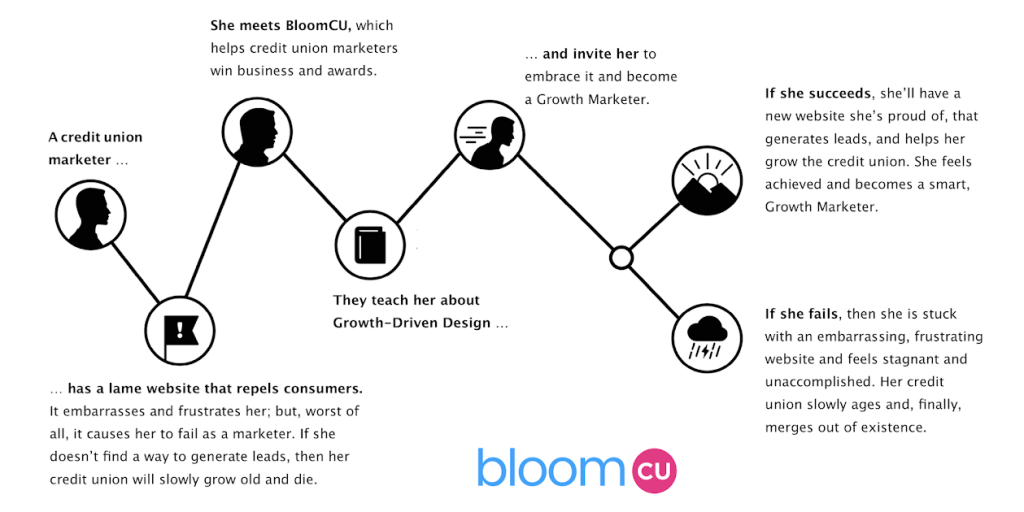

Summary: A credit union marketer with an unattractive message uses The Story Framework to transform her brand and win business.

A credit union marketer has an unattractive brand that repels consumers and she can’t get the senior managers to agree on a clear message, which makes her frustrated and confused. If people can’t figure out why they should do business with her credit union, then it will slowly dwindle until it merges out of existence.

She reads an article written by BloomCU, which has a track record of helping credit unions clarify their brands, attract consumers, and win awards. BloomCU teaches her The Story Framework and helps her write a brand story for her credit union.

She now feels confident in her message. As she shares it, she wins business and saves the credit union.

And here is BloomCU’s brand story (we specialize in credit union website design):

Write Your Story

Now I’m going to call you to action, of course. Use The Story Framework to write your credit union’s story. We’ve created a template you can use to create a snazzy infographic, like the ones you see above. Download the template, write your story, and grow your credit union.