How you will make 2016 your credit union’s best year ever

We are now less than a few weeks away from 2016.

A year that I believe is full of hope and opportunity, especially for credit unions who focus on using digital marketing to grow as consumer shopping behavior for financial services continues to evolve.

As the end of the year approaches, it’s natural to reflect on how this past year went.

Yet, many times, and I’m just as guilty of this, we sprint right into the new year without much introspection. We hurdle forward without reevaluating where we are headed.

We may have the best intentions to change and improve ourselves and our credit unions. But life happens, and we continue reactionary living and as a result, make no real progress.

Promises and Resolutions to Change Are Not Enough

It is good to have a resolve to change.

It is good to set goals.

And it is good to have a plan.

But we need to take action to change, achieve our goals, and turn that plan into reality.

However, three things often cripple our resolve to change as they stand in our way to take action.

In fact, we have seen the same three traits show up in credit union executive teams time and again through our D igital Marketing Blueprint engagements:

- The fear of the unknown

- The fear of change

- The fear of failure

As you continue to plan for 2016, take a moment to consider the following questions and think about what might be standing in your way:

- Are you planning to build a new website or improve your current one?

- How will you use content marketing and marketing automation?

- Do you have a digital marketing plan to guide you along your journey?

Where Are You on Your Digital Marketing Journey?

We understand every credit union is at a different point in their digital marketing journey.

But after working with more than 420 financial institutions over the past 14 years, we have identified ten specific areas of focus that help banks or credit unions leap ahead of their competition.

And I want you to leap ahead of your competition in 2016. That is my hope for you.

If you are one of the more than 70% of banks and credit unions who d o not have a digital marketing strategy, ask yourself the following ten questions:

- How does your digital marketing compare to other banks and credit unions?

- Have you established an appropriate budget required to achieve your digital marketing goals?

- How do your consumer personas and market segments go beyond basic demographic data?

- How do you differentiate yourself from others who promote “great rates and services?”

- What staff and processes are needed for you to achieve your goals for growth?

- What digital journeys have you documented to guide consumers through their buying cycle?

- What marketing technology platforms do you need to achieve your goals for growth?

- What process do you use to produce digital stories that emotionally connect with consumers?

- What distribution channels do you need to communicate with your key consumer segments?

- How do you quantify digital marketing success with KPIs tied back to your goals for growth?

Don’t worry you find yourself struggling with these questions. You’re not alone.

But you don’t have to be like everyone else.

You can be better.

What’s Your Digital Marketing Score?

The first step to becoming better is to gain an understanding and awareness of where you are now and where you should be.

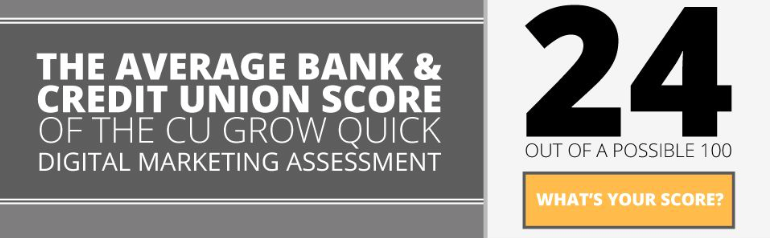

The Quick Digital Marketing Assessment will help you quickly identify your digital marketing growth areas. So far, over 50 banks and credit unions have taken the assessment. And the average Digital Marketing Score is 24 out of a possible 100.

There is obviously much room for improvement and growth.

For example, a VP of Marketing for a financial institution in Florida saw this opportunity. She reached out to us ahead of her strategic planning session hoping to gain guidance as a new website along with digital and content marketing were key strategic items for her.

But she needed a more formalized plan to help overcome her Board of Directors’ and executive team’s fears about digital marketing to gain support and buyin to move forward.

We recommended a D igital Marketing Blueprint to help her along the way, and she recently shared, “We just went over the final slides for the strategic planning session and I used several from your presentation – our CEO is very happy. Our CFO also stated marketing needs more people and everyone agreed we may adjust budget for digital marketing so all good stuff!”

Just as we have helped guide this VP of Marketing and many others along their digital marketing journey towards success, a D igital Marketing Blueprint provides clarity and confidence.

This VP of Marketing did not let her Board of Directors’ and executive team’s fear of the digital marketing unknown, fear of change, and fear of failure stand in her way.