Return on investment for credit union branching

A recent study released by the Financial Brand revealed the top priorities for financial institution (FI) marketers are: 1) Increase Wallet Share, 2) Increase Loan Growth and 3) Acquire New Customers. Given the branch has historically been a dominant tool in the FI tool belt, it would appear that these goals are challenged. In an increasingly omni-channel consumer society where branch visits are down and population per branch is low (thanks to the proliferation of branches), it would appear the deck is stacked against FIs trying to get a return on investment (ROI) from branching, while reaching its goals. This is especially true when we consider how branch use has changed.

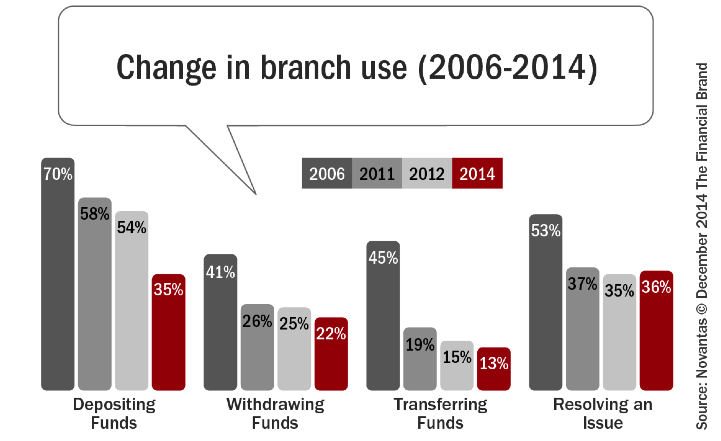

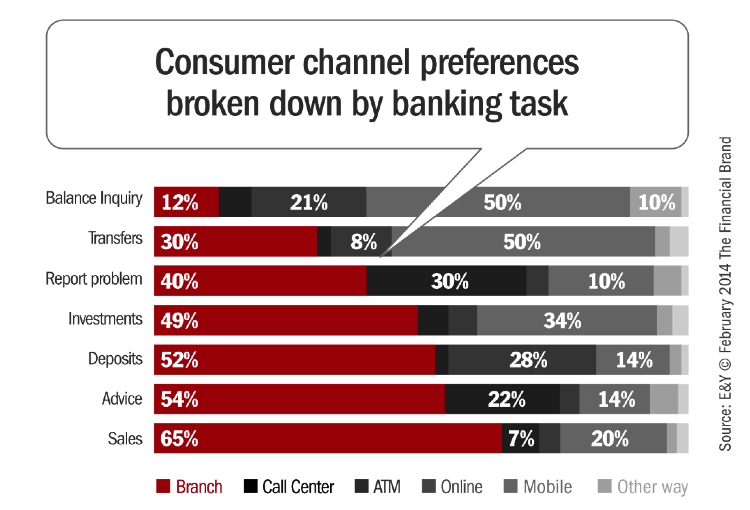

No longer is the branch the primary channel of choice for consumer transactions. Consumers today use branches for different things than they did even 10 years ago. Branch use for depositing, withdrawing, and transferring funds is a shadow of its former self. However, when we consider what the branch IS for today…there is more than a little light at the end of the tunnel.

According to an Ernst & Young survey, 65% of sales occur in a physical environment i.e. the branch. So for FIs looking for a ROI for branching look no further than sales and service for your key driver of success. With this shift in mindset comes the opportunity for a new result.

Marketers of brands like Apple and Disney keenly identify that brands change over time – they evolve. Furthermore, they know that the brand and the business are intertwined as they seek to make emotional connections with their customers to drive sales. A good example is Coca-Cola. Coke’s market cap is attributable not just to the commodity of soft drinks, but also to Coke’s iconic bottle, a physical embodiment of the brand. In fact, without the Coke brand, its value is half.

FIs can learn from other retailers and develop specific strategies to get a ROI for their efforts to market their company’s brand in its primary channel, the branch.

The journey begins with market research and analysis that drives to a business case for or against branch investment. Understanding the loan and deposit potential in a market can quickly start an effective narrative for branching by defining goals and expectations based on facts. Those facts frame our investment in land, building and people so we can predict with greater certainty what the future holds.

Then based on these facts, we build a plan to connect with the opportunity. Our engagement begins by tailoring the interior space to the culture and desired customer experience. The focus is on enabling “bankers” to easily connect with their clients. The physical identity (architecture) and signage of the branch is an extension of the culture and makes a statement to the market at large so the market knows we are different. This means we don’t run the same play every time and in every community. Specifically, we don’t always use teller lines, or pods, or self-service, but look at each market’s components and then tailor our connection.

As we build the connective environment, we are intentional to communicate our brand message in graphics, colors and materials. Our value to the community and customer cannot be guesswork because these components drive action – action taken by our employees to use these materials to cross sell, and action by the customers who are now educated on what we can offer.

Bigger banks have taken these components to heart and are leading the way on branch experience and getting great returns. In late January 2016, JD Power revealed that customer satisfaction at big banks is at an all time high, which is remarkable given the attitude of the marketplace toward big banks after the financial crisis. Big banks have learned that customer engagement in the branch is powerful and they make their value proposition clear.

The great news is we can quantify the ROI for branching using the tools mentioned above. For example, a FI in Michigan wanted to create a new customer engagement model in its community to achieve more loan opportunities. The plan included relocating a branch and remodeling a second facility with a new way of connecting, and the glue that held it together was training. The FI changed the engagement model to focus on asking questions and relationship building. They also changed their branch environment, and moved away from teller lines and used technology to automate routine activities. When the brand message became specific to the community and the FI’s mission, then the culture changed. Within the first two years, the FI has grown its loan to deposit ratio from 88% to 92%.

Furthermore, a FI in the Southwest grew from $1.0 Billion to $3.5 Billion in 5 years while maintaining a ROA of 0.80 through a similar shift. The shift included a new engagement model in the branch, messaging throughout the customer experience, and a new identity to the exterior. The exterior change was important; it helped the community identify with the change. By the way, the bank quantified the business case through research before each move.

In review, FIs can reach their goals of increased wallet share, loans and customer growth in the branch by following these steps:

- We are clear on what we want and whom we serve. Our customers are diverse and changing, so our channels must appeal to all generations.

- We tailor the message of the branch to the market, which includes doing our research and quantifying the loan and deposit opportunity – upfront. Then we focus the branch experience on the opportunity.

- Our goal is to establish an emotional connection with our customers and community to drive results. Our focus is on engagement and inviting the community in, so we listen more and talk less.

Branch ROI can be quantified and results improved with focused strategy, tactics, and action. However, the road is vigorous and requires total attention.