Securitizations vs participations: Balance sheet flexibility vs. leverage

The first credit union securitization recently closed in November 2019 (GTE Auto Receivables Trust 2019-1), undoubtedly catalyzed by the NCUA’s June 2017 opinion, issuing the authority for credit unions to undertake securitizations. Moving forward, credit unions with the scale to access the securitization market looking to liquify a portion of their loan portfolio may be exploring participations and securitizations as competing alternatives, or undertaking both transactions contemporaneously. While these transactions both generate liquidity and servicing income, their broader impacts on the originating credit union are fundamentally different.

Participations and securitizations should be evaluated as distinct strategic choices assessed within the framework of balance sheet management.

- Participations are primarily a tool for institutions looking to generate balance sheet flexibility, increase lending capacity, or de-risk

- Securitizations are a tool for increasing returns via leverage, and are most appropriately employed by institutions that have incremental risk capacity

We will elaborate upon this dynamic further as well as discuss some of the distinct and common features of both transactions and the underlying strategies they serve.

Background

When a credit union sells a participation in a loan pool, it is selling a pro-rata ownership interest in each of the loans, typically up to 90%. By contrast, in a securitization, the originating credit union sells 100% of each loan in the pool to a newly-incorporated special purpose vehicle (SPV) and then the SPV issues debt securities to structured product buyers, with the originating credit union receiving the proceeds of the debt issuance. Although structures vary (and can become quite complex), frequently the par value of debt that the SPV issues covers 90% or more of the loan pool principal, and it is the originating credit union that retains the equity in the SPV. The specific amount of retained equity in any given securitization varies and is driven by a combination of originator preferences, the underlying loans being securitized, and ever-fluctuating market-driven terms, but small equity cushions and thus high leverage ratios (10x or more) for SPVs are common.

Programmatic Evaluation

It is not reasonable to assume that a large originating credit union is intending to undertake just a single participation or securitization nor that the proceeds from such a transaction would be invested solely in risk free assets. Such an assumption would obscure the fundamental differences between participations and securitizations. Rather, credit unions likely make the decision to execute a participation or securitization transaction as part of a programmatic balance sheet management strategy and can thus be expected to undertake the same transaction again periodically. This will result in the credit union holding multiple pro-rata positions in participated loan pools or multiple retained SPV equity positions.

Programmatic Risk-Return Profile

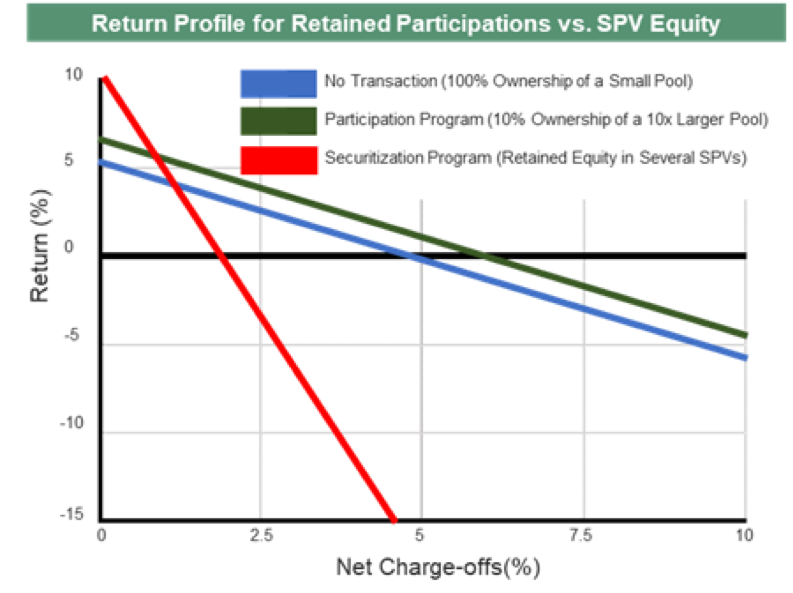

Executing multiple participation transactions ultimately results in the originating credit union retaining small ownership stakes that are diversified across a larger number of underlying loans along with the benefit of additional non-interest income in the form of upfront premiums (gain on sale) as well as servicing income over the life of the loans. These gains result in a superior, albeit similar, risk-return profile vis-a-vis a smaller number of 100% owned portfolio of loans. A securitization program results in the originating credit union retaining multiple SPV equity shares that have a levered exposure to the performance of the underlying loan (along with additional servicing income). When charge-offs are low, SPV equity will have superior returns vis-a-vis the underlying loans. However, the trade-off is that when charge-offs rise, SPV equity is in a first-loss position and the value of the SPV equity will drop precipitously. A simplified risk-return profile of a participation program versus a securitization program is shown below to illustrate the more levered risk-return profile of securitizations and the magnified credit risk exposure borne by the SPV equity that would be retained by the originating credit union.

Balance Sheet Flexibility and Risk Management

Credit unions undertaking participations receive substantial non-interest income, liquidity and de-risk individual credit exposures. Credit unions thus increase their capacity to make new loans to their members or other similar discretionary capital allocations proportionate to the amount of proceeds received each time they execute a participation. Whereas, undertaking a series of securitizations and retaining multiple SPV equity positions to seek higher returns comes at the expense of balance sheet flexibility as the retained SPV equity is a volatile leveraged asset and a significant portion of the cash received at closing may need to be allocated to assets less risky than the loans within the underlying pools to offset this volatility.

Reserve Requirements and Accounting

The reserve requirements for participations are similar to the reserve requirements for the original underlying loan pool simply reduced by the portion sold. For securitizations where the credit union retains equity in an SPV, a greater amount must be reserved for potential losses. Additionally, for the retained SPV equity, more complex accounting rules apply and, given typical securitization leverage ratios well in excess of 10x, a 1% decline in the value of the underlying loan collateral will have an amplified deleterious impact well in excess of 10% of the value of the retained SPV equity.

Fixed Costs and Multi-party Legal Complexity

A participation is executed by entering into a bilateral agreement between the selling credit union and the buyer(s). It is a relatively simple legal document and standardized agreements are widely available that are familiar to credit unions and brokers active in the market. Broker fees, if any, associated with participations typically fluctuate with the size of the underlying loan pool.

In contrast, a securitization will have both underwriting fees that fluctuate with the size of the underlying loan pool as well as significant fixed costs associated with the incorporation of an SPV, ongoing retention of a bond indenture trustee, a backup servicer, and payments to rating agencies (e.g. Moody’s, S&P or Fitch) that are governed by a set of legal agreements that are more complex and expensive to draft than those used to execute participations. These costs are a drag on SPV equity returns and make securitizations prohibitively expensive for smaller pools.

Similarities Between Participations and Securitizations

Participations and securitizations share some common features that can obscure their fundamental differences and the distinct goals they accomplish. Both transactions:

- Generate future servicing income for the seller

- Can generate approximately the same amount of immediate proceeds

Conclusion

Participations and securitizations can both be economically efficient tools for larger credit unions. However, it is important to recognize that these transactions accomplish different goals and that each should be approached as a strategic balance sheet management decision with long term flexibility, risk-management, regulatory, and accounting implications. Participations enable balance sheet flexibility because the entirety of the liquidity generated can be used to make additional member loans or de-risk the balance sheet. Securitizations are better suited for credit unions that wish to seek increased returns through increased leverage and have incremental risk capacity.

For further detail on securitizations and their relevance to credit unions, please refer to:

-

NCUA Opinion dated June 21, 2017 titled Authority to Issue and Sell Securities:

https://www.ncua.gov/files/legal-opinions/asset-securitization-authority.pdf

-

The Securitization Markets Handbook: Structures and Dynamics of Mortgage- and Asset-backed Securities by Charles Austin Stone and Anne Zissu