Seizing the next big opportunity: A strategic blueprint to engage Gen Z

As credit union boardrooms buzz with discussions on immediate priorities like liquidity and income, there’s a tremendous opportunity that’s waiting to be tapped: Engaging the younger generation.

Did you know that only 4% of credit union members are from Gen Z? And, surprisingly, nearly a quarter of millennials aren’t even familiar with what a credit union is. When we do manage to bring younger members on board, keeping them engaged is another challenge. Only 20% of Millennials under 25 see credit unions as their go-to financial institution.

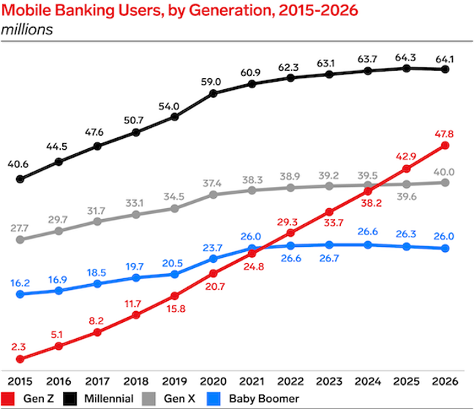

But here’s the exciting part: By 2025, Gen Z is set to overtake Gen X in total mobile banking users, and will represent a whopping 27% of global income by 2030. This isn’t just a statistic, it’s an opportunity.

Those hesitant to generate a Gen Z strategy may also consider the cost of inaction: If credit unions don’t start rejuvenating their member demographics now, what does the future hold for the industry?

Engaging Gen Z might seem daunting. Their unique characteristics, such as shorter attention spans and a demand for tailored content, make them challenging to reach and engage. But the solution isn’t necessarily about outdoing regional and megabanks. It’s about finding fresh, innovative ways to do what credit unions do best: building trusted relationships, early.

- Be their first choice: Gene Pelham, the visionary former CEO of Rogue Credit Union, remarks, “by the time students head to college, they’re swamped with choices. To resonate with Gen Z, we must make a lasting impression from ages 0-18, ensuring we’re a top choice as they mature.” Rogue’s “student branch program,” where students run branches within their schools, is a shining example of this.

- Build trust through shared values: Gen Z isn’t just about digital. They align with brands that reflect their values, be it social responsibility or community development. They’re also hungry for financial knowledge surrounding credit scores, interest rates, and responsible spending. Fortunately, credit unions, with their community-centric ethos, are in a prime position to meet these expectations with a personal touch.

- Engage, engage, engage: Bringing Gen Z on board is just the beginning. As they step into adulthood, guide them. Finalytics’ recent observations underscore the importance of continuing to cross-sell to this group over time. As they go off to college, send them a note on the importance of opening a credit card, or how to begin saving for purchases that matter. Before you know it, your credit union will be the trusted source they call on during their prime borrowing years.

The future of credit unions can be bright, and Gen Z is a big part of that picture. By taking the time to develop a strategic blueprint and bring on the right partners, credit unions can ensure they play a pivotal role in Gen Z’s financial journey.

Ready to dive deeper?

Seeking actionable ways to weave these steps into your membership strategy? We’ve got you covered. Sparrow is hosting a free webinar on Thursday, September 20th titled, “Insight to Action: Building Relationships with Gen Z.” We hope you’ll join us! Register here. Discover actions leading credit unions are taking to resonate with Gen Z and hear inspiring stories about vendors making impactful strides in this domain.