Stop handing over auto loans to your competitors

According to chief economist of the National Automobile Dealers Association, Steven Szakaly, U.S. new-vehicle sales will stay above 17 million for a third straight year in 2017. Szakaly also said he believes that auto purchasing and leasing momentum will continue to build in 2017. With this increased car activity on the horizon, you should be establishing a strong plan for scooping up these potential auto loan opportunities.

It has become increasingly hard to pull in new auto loans with the level of choice available to car buyers today. Financial institutions are no longer just competing with the usual suspects – big banks, finance companies, and other financial institutions – they are also having to compete with less traditional businesses that are entering into the auto loan game to expand their services and draw in new consumers. Retail lenders (like Costco), mobile lenders (like Credit Karma), and peer-to-peer lenders (like Lending Club) are among the types of non-traditional lending companies financial institutions now have to compete with.

Even if you have a strong auto lending program, you are likely still losing loan opportunities to your competitors. It is hard time you start thinking outside of the box to take your auto loan portfolio to the next level of success. Let’s take a look at some things your organization can do to separate you from the rest of your competition.

Mobile Banking

First and foremost, if you are not currently offering your account holders access to online banking tools, you need to be doing that. According to a recent report performed by Callahan & Associates, loan growth and asset growth in 2016 was more than double for credit unions with mobile banking than that of credit unions not offering mobile banking.

If you want to attract financially active consumers to your auto loan program, your mobile banking tools should also include a mobile loan application. Mobile lending adds a level of convenience that consumers are craving, especially your harder-to-reach millennials who typically prefer the mobile channel for performing all of their banking transactions. You must offer mobile lending to effectively engage these key demographics, or else risk losing these opportunities to your competitors, which include both traditional and non-traditional.

Auto Rebates

These days you can’t always expect individuals buying or leasing a car to walk up and ask about your auto lending program. It is true that there are a growing number of consumers looking to credit unions for their auto financing needs, but there are still many individuals out there that are just looking for the best offer no matter who is offering it to them. If you want to attract new borrowers, you need to offer them an auto lending program that includes unique, valuable benefits, so you are presenting them with an attractive offer that stands up against your competitors’ programs.

Arthur J Gallagher & Co. (Gallagher) saw this need, and set out to create a unique and attractive benefit program that was a win-win for businesses and consumers. The core of this program, called BonusDrive, offers an exclusive $500 rebate to consumers leasing or purchasing a new vehicle from a participating brand. “We developed BonusDrive to help auto buyers and their families get the best deal possible on a new car, while at the same time be a value to the businesses offering the BonusDrive program,” says Jim Evans, Global Practice Leader of Voluntary Benefits Consulting for Gallagher. “We are confident credit unions marketing this program will see a boost in good will and loyalty, while positioning themselves at the top of their consumers’ minds when they are ready to shop for auto loans.”

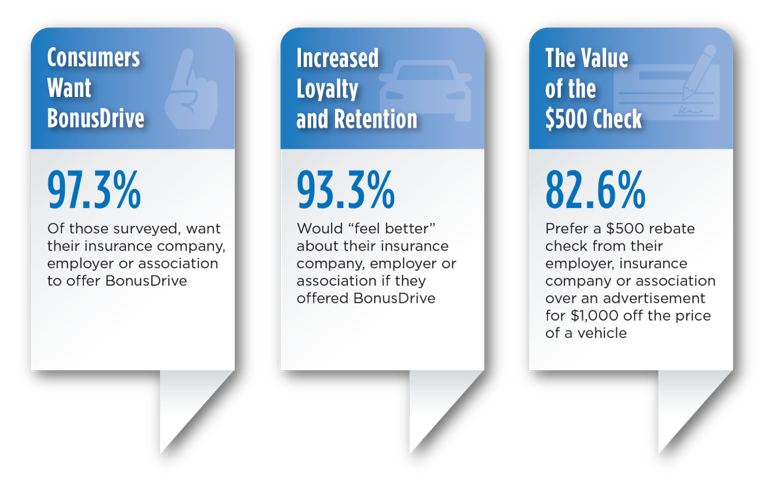

Gallagher performed a study in 2016 to help gauge consumer interest in the BonusDrive program. They found that just about any individual presented with a cash back rewards program like BonusDrive would be interested in participating. And since this program is no cost to you, and no cost to the consumer, it is really a win-win for everyone involved.

“The moment I heard about the Bonus Drive program I knew it would be a success for our customers,” says Pete Hilger, President and CEO of Allied Solutions. “There is no question in my mind about the value this program brings to credit unions and their members. In fact, our current BonusDrive clients already have members redeeming the $500 payouts, and they’ve only been marketing the program about a month. The program basically sells itself.”

Direct to Consumer Marketing

Programs like BonusDrive and other consumer benefits you offer don’t just sell themselves; you have to market these offerings to your consumers. But that alone can be a huge challenge for your financial institution. Nowadays, most consumers expect advertisements to be tailored to their individual wants and needs. You can’t just send out a generic flyer to every consumer and expect great results. If you want real results, you need to send out customized communications that speak to what each prospective consumer may be looking for, when they may be looking for it.

Newer marketing tools like video and text marketing offer the ability to create targeted custom campaigns that market the right products to the right people. For example, with video marketing tools like Allied Solutions’ SmartVideo technology, you can develop short, personalized videos to send out BonusDrive information to your consumers who recently filed a GAP claim and may be in the market for a new car.

These newer marketing tools also allow you to track and analyze campaign results down to the individual level. Having this information can help you categorize recipients of the initial campaign so you can more effectively follow-up with targeted communications.

There are certainly other ways your financial institution can draw in auto loan opportunities away from you competitors, but the options included in this article have proven to be successful for financial institutions that have adopted one or more of these methods.

Contact Betty Seifu with Allied Solutions if you’d like to learn more about building up your auto loan portfolio: 800.826.9384 Ext. 10175.