Taylor Swift has it right: Haters gonna hate

My daughter MacKenzie recently returned home from lacrosse camp. I was running on my treadmill when she arrived home. She zipped upstairs as I ran and chatted with me as I finished. After a few days away, having my only daughter back in the house felt like a delicious and warm meal after camping and hiking for a week: refreshing, renewing, and invigorating. MacKenzie’s energy fills our home. She chattered about the friends she made. She shared that her roommates did not like her and that the “high school girls” didn’t seem to like her either. Yet her spirit felt light and joyful.

The next afternoon, MacKenzie awoke from a nap and immediately laid back on our kitchen bench. Her face fell, and her melancholy demeanor was palpable. As I asked questions to gauge the situation, she slowly revealed she was “Thinking about why the girls at camp didn’t like her.” My heart sank, and my mama bear instincts roared. As a parent, I hope to walk with MacKenzie toward self-confidence. I want to help her avoid the heartbreaking insecurity and worry I experienced in middle school. Despite our best intentions, it was a stark reminder of how little we can control in life.

Facing harsh criticism and learning how to approach critique is also an essential leadership lesson for credit unions. At CFCU, we recently revealed our brand refresh. As we shared the plans for our new approach to storytelling with our team and our Board of Directors, I shared what I learned through leading brand identity changes throughout my career, “We will know we’ve done it well if not everyone loves it.” This caused some eyebrows to lift. Very few people wish to hear that something they’re leading will receive an adverse reaction.

Change shakes all of us – even those of us who love it. Leading change can also be frustrating and confusing because “People fear that after the change, the organization will no longer be the organization they value and identify with – and the higher the uncertainty surrounding the change, the more they anticipate such threats to the organizational identify they hold dear. Change leadership that emphasizes what is good about the envisioned change and bad about the current state of affairs typically fuels these fears because it signals that changes will be fundamental and far-reaching. Counterintuitively, then, effective change leadership has to emphasize continuity – how what is central to “who we are” as an organization will be preserved despite the uncertainty and changes on the horizon,” according to Harvard Business Review’s “To Get People to Embrace Change, Emphasize What Will Stay the Same,” by Venus, Stam & van Knippenberg.

With this in mind, we are leading our brand refresh as an ignition of CFCU. We emphasize how our history informs and strengthens our bright future. Our community commitment, cooperative structure, human-first approach, lending focus, and dedication to more than 50 student-run branches will all remain the same. We’ll build on that to reduce confusion about our name, expand our reach, become known as the place for savers, build a digital-forward experience, and deepen the opportunity for impact.

We’ll bring that to life through a brand that uses new iconography grounded in our Michigan roots emanating from a commitment to “defending” our members; vibrant colors that leap away from the volumes of abundant messaging we all receive; simplified and relatable content; and an ongoing approach to bringing our story forward. This moves us away from a palate of blue and a more traditional approach. That change resonates fully with some and feels jarring to others.

In the age of social media, brand reveals bring criticism forward quickly and sometimes in volumes. While we did not experience a deluge of frustration with the new brand, we did have some negative comments. People on our team asked questions about our response. Best practices within social media begin with consistent monitoring and engagement holistically to share the “why.” However, engagement with each harsh message typically does not make sense as it tends to fuel even more negativity.

CFCU has been growing an even stronger voice of the member strategy since June 2022. As we listen even more closely to our members across various listening posts, we work hard to respond to their concerns to strengthen the organization. With all of this listening, some team members wondered why we wouldn’t shift our approach with negative comments coming through our social channels.

Our holistic voice of the member strategy allows us to listen more robustly and avoid overreacting to individual comments. Consolidated feedback enhances a scientific approach to understanding trends leading to meaningful change grounded in member input. This honed listening effort truly enhanced our ability to manage the brand transformation.

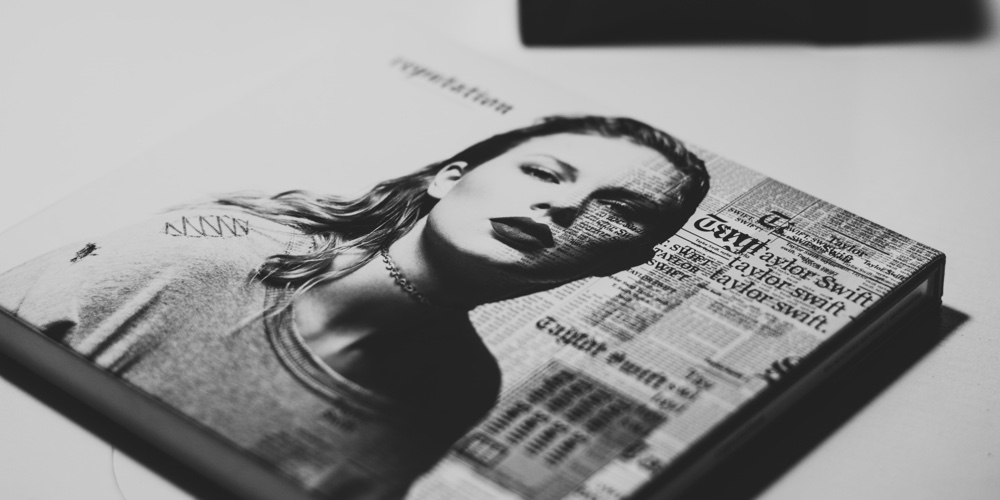

As MacKenzie shared more about her worries about the girls who “didn’t like her at camp,” I asked her to sit up. I sat behind her and held her close. I whispered in her ear, “Do not let anyone else take away your joy. You are an incredible human being. Remember the friends you did make. Stay close to the friends you have. Feel the stones in the base of your spine from the family that loves you. You are stronger than you realize.” My words did not transform my nearly teenage daughter’s demeanor. As social creatures, none of us likes to hear criticism, negativity, or harsh words. The commonality between middle school and brand transitions brings us back to the lyrics of Taylor Swift’s “Shake It Off:” “Haters gonna hate, hate, hate, hate, hate.”

According to Credit Union National Association, as of 2022, credit union’s held 9.4% of the U.S. market share of deposits. Storytelling is not the only solution to credit union’s becoming the choice for Americans, but it is an integral part of it. Our competition is not only the bank down the street but the many FinTech choices at our fingertips. Bold, consistent, well-researched, profoundly engaging, and sometimes “hated” messaging will help us grow the number of people credit unions serve, ultimately ensuring more dreams come true. As MacKenzie will, all of us as credit union leaders managed to survive the pain of middle school. I know it’s worth “shaking it off” for the betterment of those who have yet to see the credit union difference and those who already have.