Three credit union financial trends and economic implications

Credit unions saw an explosion of balance sheet growth throughout COVID-19, primarily related to government relief loans and increased savings rates during the height of the pandemic. As we move further away from the impacts of the pandemic, here is what we’re seeing in 2022, and what that means in the context of the forward-looking economic environment:

Loan Growth Outpacing Share Growth

Credit union balance sheet growth has been dominated by loans in 2022, with the industry loan-to-share ratio jumping from 68.8% in the first quarter of 2021 to over 70% in 2022. This increase is a result of an 11.7% loan growth rate as compared to an 8% growth rate on shares.

Growing Auto Loan Market Share

One reason for the loan dominated balance sheet growth is that, according to Experian, credit unions have been more competitive in capturing market share for auto loans. Credit unions have captured approximately 25.8% of 2022 auto loans as compared to 18.3% in 2021, with this additional volume being taken largely from banks and captive lenders.

Growing Delinquency despite High Credit Scores

According to Experian, used auto loans have the strongest credit scores in recent history with nearly 55% of used auto loans having a credit score of 661 or above. While credit scores remain high, we’re seeing increases in delinquency. Approximately 0.70% of auto loans are currently 60 day or more delinquent as compared to 0.45% just a year ago. While we have seen an increase, delinquency remains slightly below pre-pandemic levels.

What this Means for Credit Union

Qualitatively, these trends suggest that, after increasing savings rates in response to the pandemic, consumers deployed capital in 2022 to finally buy a vehicle or a home.

A changing balance sheet composition more heavily composed of loans brings with it higher reward (yield), but also greater risk. With a perfect storm of demand increasing factors like (a) money pumped into the economy as a result of government relief programs, and (b) personal savings stored for potential pandemic impacts that never came, combined with supply chain disruptions as a result of economic shutdowns, inflated asset prices have the potential to make 2022 a challenging vintage year for collateralized lending.

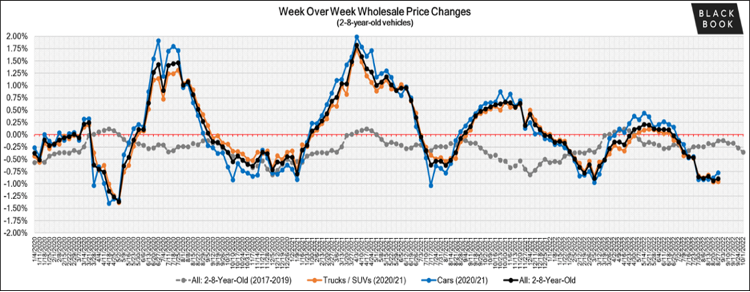

For example, according to BlackBook, after seeing almost entirely positive week over week wholesale price changes in 2021, values have begun to correct in 2022, particularly doing so consistently from July 2022 and thereafter. This suggests that recoveries on charged off vehicle loans will weaken as we enter the fourth quarter of 2022 and move into 2023.

Consumers are spreading themselves thinner to buy more expensive vehicles at higher interest rates. Approximately 29% of vehicle loans in 2022 have a term of 73-84 months as compared to under 24% in 2021. Additionally, only 28.7% of auto loans have a term of five years or less as compared to 33.3% in 2021.

We have seen high rates of inflation in 2022, which means the dollars consumers hold don’t go as far. The increases in interest rates made to curb inflation exacerbates that issue by also reducing the purchasing power of dollars borrowed.

While a recession has not been formally announced as of the date of this writing, we are currently facing tangible economic challenges that impact loan risk. Credit unions should consider their risk profile from the top-down, assessing capital adequacy whiling aiming to diversify the loan portfolio and mitigate the combination of credit and collateral risk to best serve members.