How the CECL standard impacts accounting for debt securities

The CECL implementation deadline for credit unions is quickly approaching. Most have already begun compiling historical data, reviewing the different models for estimating their CECL reserve and discussing how the transition will impact their 2023 reports. For a credit union to fully implement the new guidance in ASC 326 (the CECL standard), management will need to review existing debt securities by classification.

Classification of Debt Securities

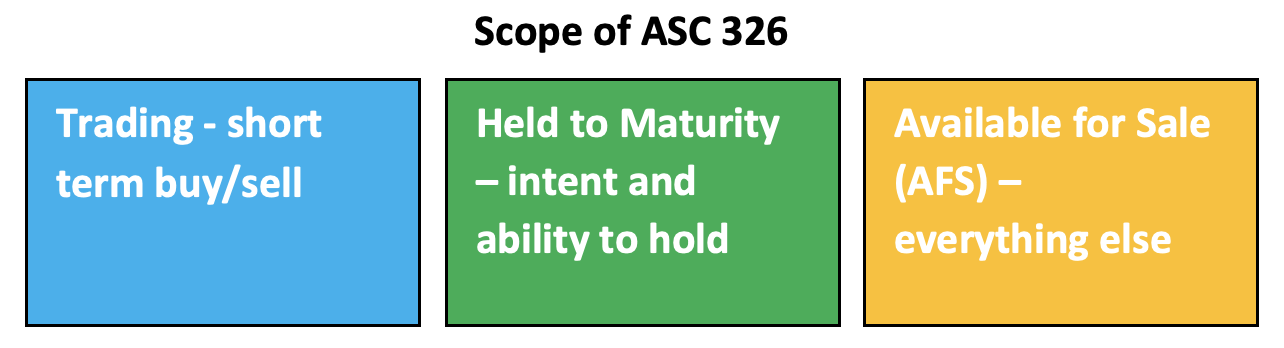

For financial reporting purposes, current US GAAP requires credit unions to classify their debt securities into one of three buckets: trading, available for sale, or held to maturity. Classification impacts how these securities are reported on the balance sheet and how changes in their balance flow through net income. Only held to maturity and available for sale classifications are impacted by the new standard.

- Trading securities are securities that management has intent to buy and sell with the goal of profiting in the short term.

- Held to maturity securities are securities that management has the intent and ability to hold until the security matures.

- Available for sale (AFS) is a default category for all securities that do not meet the requirements to be classified as held to maturity or trading.

Held to maturity securities are reported at amortized cost on the balance sheet, unless a fair value election has been made. CECL requires that management make an allowance for current expected credit losses over the life of the security. The same models that management has selected when implementing CECL for other financial assets can be used for held to maturity securities. All financial assets reported at amortized cost on the balance sheet follow the CECL model.

Available for Sale Debt Securities

Things get a little trickier when talking about available for sale securities. There is some confusion about the application of the CECL standard to AFS securities, because they don’t fall under the same model as securities reported at amortized cost. However, an entire section of the new standard is devoted to AFS securities.

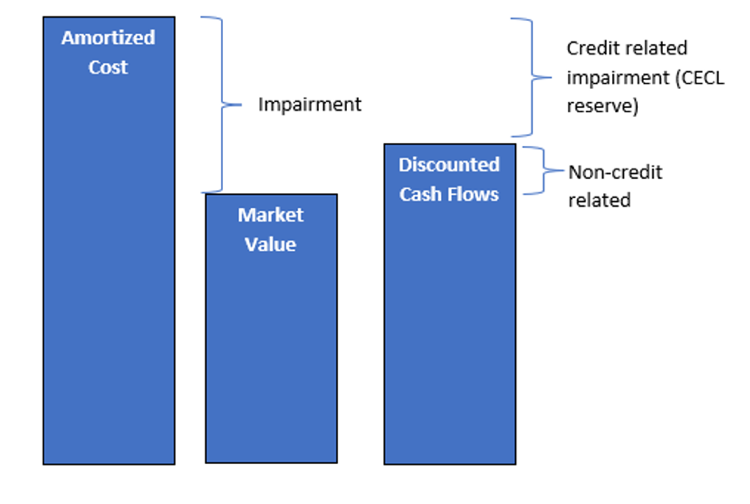

The new standard requires management to assess whether a decline in market value below amortized cost is related to credit losses and record an allowance instead of the old other-than-temporary write down.

Unlike the CECL model for financial assets reported at amortized cost, the new standard requires AFS debt securities to be assessed individually for impairment and not pooled with similar securities. If a credit loss is expected, it must be calculated using a discounted cash flow model.

The credit loss for AFS securities is limited to the excess of amortized cost over market value. If a credit union calculates discounted cash flows and finds them to be less than market value, the credit loss is capped at the difference between market value and amortized cost.

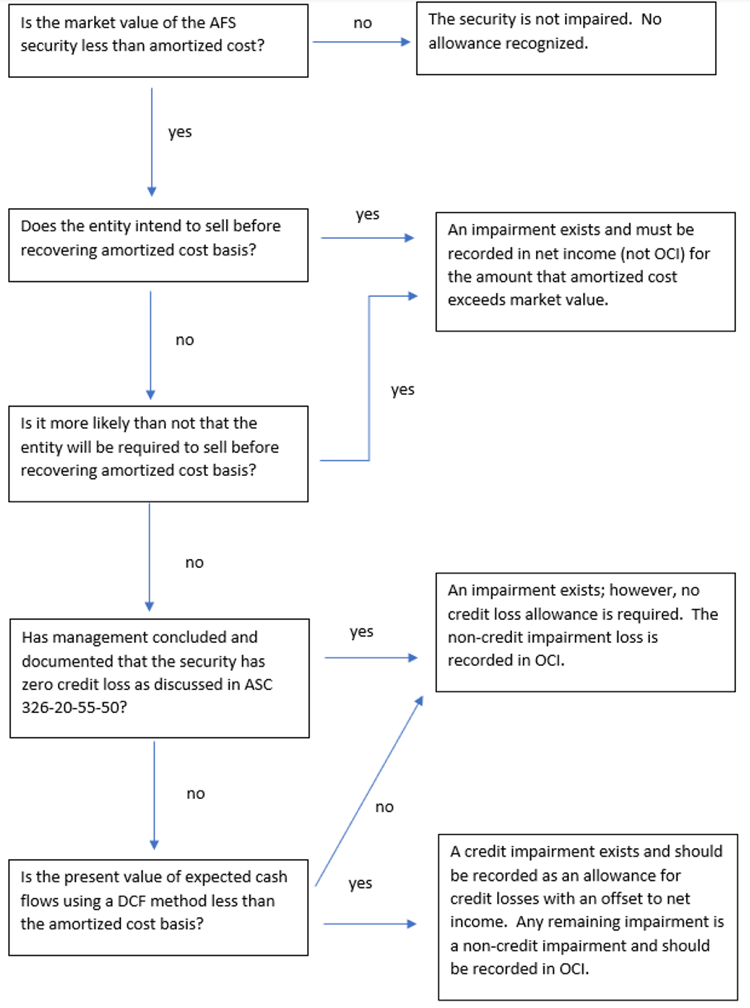

The following flow chart walks us through management’s decision tree when determining how an impairment should be recorded.

Securities with zero credit loss

Many credit unions have a large amount of treasury securities and U.S. government backed mortgage securities in their investment portfolios. Much discussion has been centered around whether these securities are automatically considered zero credit risk securities. While CECL does not explicitly list securities that would be exempt from credit loss, paragraph ASC 326-20-55-50 reasons that the explicit guarantee of the US government is enough to conclude that a credit loss reserve is not required for US treasury securities. Some experts have arrived at the same conclusion for U.S. government backed mortgage securities guaranteed by Ginnie Mae, Fannie Mae and Freddie Mac. It will be interesting to see how auditors and examiners feel about this “get out of jail free card”, but it could go a long way in reducing implementation cost for smaller financial institutions.

In conclusion

Start reviewing your debt security classifications today to determine if they fall within the scope of the new standard. If you need help navigating the new standard or have questions about how your debt securities will be effected, contact 2020 Analytics.