Three steps to creating economic lemonade

Sometimes life throws you an unexpected gift. They may not feel like gifts at the time, for instance, getting a new boss just when you got into the grove with the old one, or perhaps a crazy stock market, (box checked). It is not about why these situations happen, but identifying what opportunity presents itself.

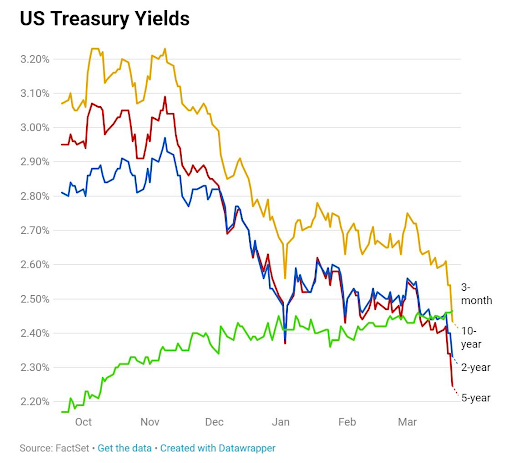

Recent economic indicators (I am looking at you, inverted yield curve) are pointing to the potential of a recession. While this action may elicit a bit of a nervous twitch in some, and a rapid pulse in others, the best reaction is to take two steps back calmly. Take a moment to assess the current environment for any opportunities that might be available.

Here are a few actions you can take today to start making lemonade out of potential lemons.

1. Take stock of the organizational learnings.

Thank you to the Great Financial Crisis (okay, perhaps thank you might be a strong word) Credit Union Leaders are smarter, better prepared, and ultimately wiser. The opportunity of a changing economy could be in the way you serve your member. Consider the following members’ perspectives in the analysis of the changing economic landscape.

What do you know about your members?

Are they looking to retire?

Buy a home?

Sell a home?

Start a family?

Become empty-nesters?

Credit unions have more data than Amazon. Yes! Credit Unions have more data than Amazon. So what can you do with it to understand your members and help them during this potential economic time?

2. Leverage the data you have on your member to understand them better.

Credit unions have more data than Amazon. Yes! Credit Unions have more data than Amazon. How to leverage all this data is the question.

Let’s start with a member needs assessment.

If your member data is segmented via financial product demand, channel usage, age income, credit score, debt, and current product and services? Fabulous. If not, identify a way to extract this information either from a flat-file from your core processor and upload it into PowerBI or other analysis software.

Next, begin to look at the patterns, members with like products will become your segments.

The benefit of segmentation is the consolidation of membership into 8 -12 different groups. Think of these segments as 8-12 different people sitting around your conference table talking about their needs. You can gain further insight by diving deeper into the credit/ debit card and payment transaction data, identifying purchase spend behavior. Member spend is fascinating as it provides valuable insight to a members current situation.

Understanding which retailers and retail categories members are purchasing from and when (frequency) create patterns that can be the texture to the member tapestry.

For example, let’s say the key retailers to a specific segment are Amazon, Paypal, Nordstrom’s, Best Buy, and Target. This segment is also heavy mobile users with an auto loan and credit card. What theories can you test? Perhaps adjust or create a credit card loyalty card offering to provide more incentive to spend in these and like retailers. Another action could be increasing credit limits for the holidays. Creating or launching a skip a payment program for either the auto or credit card for next year that could help members should they need it. It is crucial to proactively reach out to your members as the economy changes and letting them know you are here to have their back. This action will be appreciated.

3. Appropriate engagement channel

The exercise above identified a few solutions to help improve the lives of the member. In delivering this solution, it is mission-critical to use a channel that is most appropriate to the member. This may sound obvious. However, it is rarely executed consistently. If the member is a mobile user, deliver a solution that can be executed using a mobile device. Please do not direct them to call or visit a branch. While that may seem like the best and perhaps the most convenient process for the credit union, it is not to the member. That is what Amazon has leveraged. How to increase purchases 7/24. The “buy it now” and “buy it again” buttons have streamlined the purchase process and experience for their customers. How can you make sure you are removing as many obstacles as you can for your member to engage with you. Knowing your members preference for engagement channel is key to success as well as making sure that hey can engage in the channel.

While nothing is entirely certain about the economic future, what is certain is that it is cyclical, what does increase will decrease, so it is not what, but when. The goal of credit unions is to serve the member economic lemonade in both the highs and the lows. Leveraging the robust data will be the secret ingredient to the recipe. Mix well and serve chilled.