To the experience age, and beyond: Gratifying members in a digitally dominated world

We live in a very fast and digitally dominated world – welcome to the Experience Age. The faster and easier we can get anything, the faster and easier we want EVERYTHING. Missed your favorite show last night? Talk into your remote to access it on video on demand today. Want to learn what the newest meme stock is? A quick search on the Reddit app will tell you. What do both examples have in common? Being digitally optimized. However, when it comes to financial institutions, there tends to be a sluggish movement towards digitally transforming – possibly due to cost, resources, old technology, or all/none of the above – that is leaving them to play a game of catch-up instead of being an industry leader to consumers. And, for the member seeking instant gratification when it comes to their banking – slow and steady is not winning any races.

Let’s dive in and learn more about the Experience Age, what consumers are looking for in this digital era, and how you can best position your credit union to stand out to potential and current members.

How Did We Get Here?

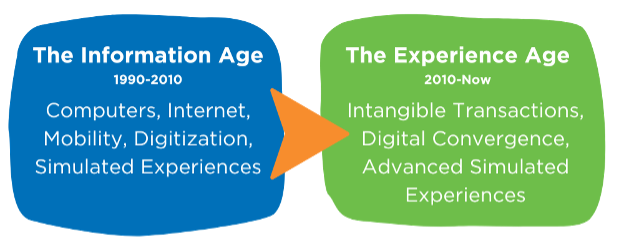

What is the Experience Age? It’s where we currently are digitally and economically. It’s how we interact and the experiences we have with everything from people to products. Prior to this, the Information Age brought us computers, the internet, and set the foundation for sharing information digitally. The Experience Age is taking that a thousand steps further. Here, our digital experiences are advancing to where artificial intelligence and other smart technology are improving efficiencies and changing how we live and work together, and apart.

How Did We Get Here?: The Information Age vs The Experience Age

The Age of the Consumer

The Experience Age also brought us the Age of the Consumer. With the ability to interact digitally, consumers have more options when it comes to choosing their products and services. Now that the consumer has the so-called upper hand, it’s up to businesses to keep up with consumer demands and make the customer experience a top priority. These experiences, both good and bad, can quickly be communicated to the masses. With the ability to use video, social media, and public review sites, consumers can now potentially make or break a business almost instantly – all courtesy of the Experience Age.

When it comes to your members…

Q: What are your potential members looking for right now?

A: On-demand service.

Q: How do you provide on-demand service?

A: By digitally optimizing with the latest technologies.

A Cornerstone Advisors survey found that the top five technologies consumers want from their financial institution of choice in 2022 are digital account opening, chatbots, machine learning, P2P payments, and digital loan origination). Chatbots were #2 on the list of consumer desires!

Without the will to invest to improve the customer experience, there wouldn’t be industry leaders – for both the consumers and businesses. Tech and software companies are putting millions of dollars into changing the future of how we live and work. It’s about being the fastest, smartest, and most competent in the game to stay ahead of the competition.

Harvest Your Digital Crops

Did you know the technology and products you need to keep your credit union moving digitally forward are already being utilized by your competitors? The seeds of digitally optimizing have already been planted and are waiting for you to harvest.

If your credit union hasn’t begun the digital optimization journey, here are three ways to dip your toe into the proverbial water to get you off the ground and start to instantly gratify your members (and, as an added bonus, become more desirable to future generations who are looking for a fully digital financial experience).

- Digital Lending Platforms – helps borrowers get approved for a new loan remotely

- AI Virtual Assistants – call automation improves the customer service experience, increases revenue, and reduces costs

- AI Credit Decision Platforms – instant loan decisions powered by artificial intelligence that can generate more approvals with lower risks

The Experience Age is marching on, and technology will continue to develop. The digital optimization process will be gradual, and probably never-ending as advancements are continually made. Building these advances into your strategic plans moving forward will only help position your credit union as a forward-thinker who keeps their members’ satisfaction a top priority.