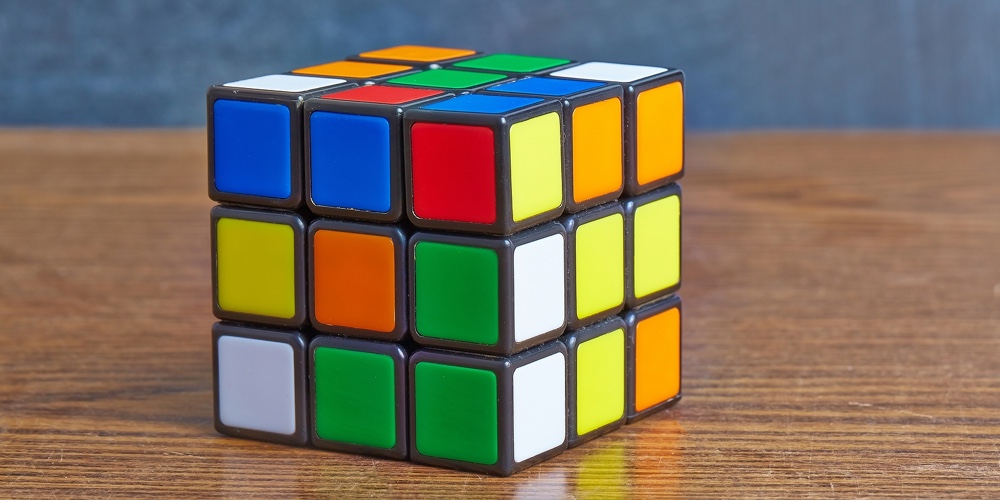

Understanding the Rubik’s Cube of loans, earnings and risk

Why loan officers and financial departments must work together

“There are…wait for it…43,252,003,274,489,856,000 ways of arranging the squares, and only one of these is the solution. Turn and twist away—can you solve it?” Can you guess what that quote is referring to? If you guessed the Rubik’s Cube, you’d be right.

How many of us played this mind-teasing game as kids, and probably adults, for hours on end, trying to find all the connections and make the right moves to solve the puzzle? The twists and turns you make determine each subsequent action, which involves a lot of intentionality and precision, and ultimately leads to finding the right solution. Well, for some of us, anyway!

You may not realize it in your day-to-day role at the credit union, but the same process is true of lending and its impact on the overall earnings and risk. Those connections and the careful, calculated moves are exactly what you need to figure out how to find a balance between your lending strategy and your balance sheet.

Like the Rubik’s Cube, the lending team needs to understand the full financial goals of the credit union to make sure their turns align with the larger credit union position. Since all of these pieces are intertwined, let’s explore those relationships a little more to gain a better understanding of the role of the loan.

continue reading »