When it comes to corporate communications: Let it rain

Corporate communications at many credit unions is like snow in the Pacific Northwest. It comes infrequently, no one’s planned for it, it sometimes causes a mess, but many feel exuberant when it happens. Before you know it, though, it’s gone and won’t be seen again for a long time.

To be effective, corporate communications at credit unions could take a cue from rain in the Pacific Northwest. Be steady and bountiful — leaving fertile ground.

Why is corporate communications unpredictable at so many credit unions? Why isn’t it more constant?

It’s not for lack of good intent. CEOs and credit union leaders face unpredictable weather right now, which is why their staff need steady and constant internal communications, as they’re facing storms too. The following three areas often keep credit unions from experiencing the bottom-line benefits deriving from corporate communications.

- Resourcing

- Lack of understanding

- Lack of prioritization and urgency

How can leaders overcome each?

Resourcing

Unless they are large, it’s not been the norm for most credit unions to have communications departments, vice presidents and/or directors of communications. They may have someone handling social media, but not all credit unions have someone to:

- Define communication goals and translate them into KPIs

- Segment workforces into different audiences and access their communication formatting preferences

- Create insights-driven content calendars

- Develop coordinated scripts, presentations, and Q&As for events

- Craft CEO and executive communications

- Bring unity and clarity to HR, training, and process communications through oversight

- Draft and finalize content for internal campaigns

- Manage crisis communications

- Bring life and continuity to strategic plan messaging year-round

- Oversee M&A communications

Some assign this work to HR or Marketing. Others try to have executives take it on themselves. Or they get updates on this information and have subject-matter experts (SMEs) cover it in monthly all-staff meetings, thinking it will be enough.

A recent survey by NovoEd, though, showed that as many as 43% of lower-level employees feel somewhat disconnected with their co-workers and senior leadership. Recent studies by Gallup and ThriveMyWay revealed that 50 to 60 percent of employees say they are burned out, for reasons including needing to be available 24/7 for their employers, lack of support by their managers (many of whom may also be overwhelmed), unreasonable time constraints, and other reasons.

Bottom line – who, what, when, why, and how you communicate with staff right now – matters.

In 2023, leaders have the following options:

- Restructure to add corporate communications duties to someone on your staff

- Bring on a new resource

- Hire a corporate communications consultant

Many executives may think they don’t have the bandwidth, time, and/or budget to choose an option. After all, for the past 50 years or so, credit unions have been just fine without placing critical focus on this area. However, just like having a 6.0 net worth has risk, so does having spotty corporate communications. Why?

Lack of understanding

If those recent surveys aren’t enough to get leaders’ attention, just know that it takes multiple iterations for a message to get through. That’s why executives constantly shake their heads wondering why they get the same questions over and over, when a message has been communicated already.

Messages need targeting, timing, and shaping – not to mention planning and strategy. So, when employee engagement is down and/or people just “aren’t getting it,” it’s often a symptom of more than just post-pandemic shifts and/or any recent changes.

It’s also often a symptom of how and when those changes have been communicated about.

Just as there are ALM experts who shock balance sheets, there are communications experts. Here are just some of the ways they can impact:

- Educate, inspire, and activate employees by speaking directly to them

- Develop strategies and varied campaigns (with built-in reinforcement) targeted for impact

- Conduct surveys and focus groups for insights

- Tap data and analytics for continuous improvement relative to meetings, events, and channels

- Utilize change management principles and adapt campaigns appropriately to garner buy-in

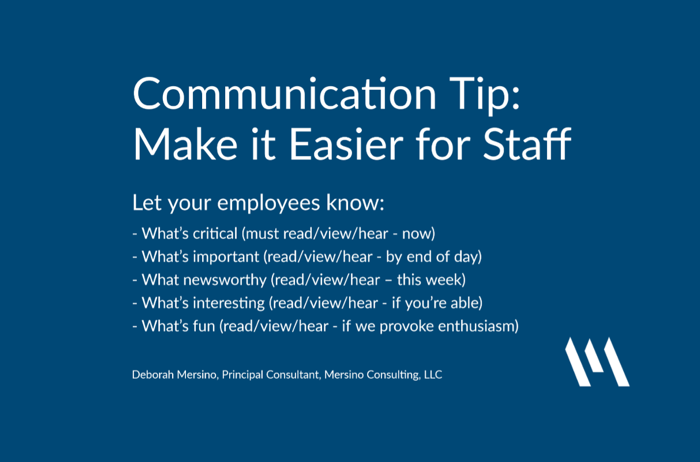

- Understand the nuances of using multiple communication channels and let employees know what’s critical when

Lack of prioritization/urgency

When rising interest rates, liquidity, charge-offs, housing market shifts, and board demands hit like lightning bolts, it’s easy to see how creating the proper conditions for strong corporate communications gets less attention.

Here’s what’s at stake, though:

- Internal politics

- Confusion

- Inefficiencies

- Low morale

- Turnover

Combined, these affect bottom lines. If a credit union cannot bite off a comprehensive overhaul of internal communications all at once, it can choose an area of focus where it can make the most significant impact.

Being proactive, targeted, and intentional around audiences, timing, repetition, and channels will seed the clouds. Let it rain and see the growth!