The Pope’s Credit Union

Recent news out of the UK (The Telegraph and The Guardian) is reporting The Archbishop of Canterbury announcing plans to expand the reach of credit unions.

It appears The Reverend Justin Welby who sat on the parliamentary commission on banking standards in the UK and has been an outspoken critic of the financial-services industry, believes a successful credit union sector could pose a challenge to internet payday lenders who target vulnerable borrowers with expensive loans.

In his announcement, The Archbishop wants to see credit unions be allowed to use church halls and other properties in order to better access customers. He is also encouraging church members with relevant skills to volunteer at credit unions.

Although Archbishop Welby’s announcement did not include a commitment to deposit any of the Church of England’s vast financial wealth into credit unions, we can expect more to come from his proposal since the church is also in talks with Association of British Credit Unions Limited to see where it could best lend support.

Surprised by Archbishop Welby’s announcement? Don’t be.

The historical relationship between credit unions and the clergy particularly in Europe dates back to the very origins of financial cooperatives in Germany. According to Lawrence Beer who wrote on the topic of Credit Unions and The Church, the encyclical of Pope Leo XIII, “Rerum Novarum,” in 1891, encourages “societies for giving mutual aid,” so that, “the individual members of the association secure, so far as possible, an increase in the goods of body, of soul, and of prosperity.” As a result of this papal endorsement, the concept of the credit union received widespread commendation and active support throughout Europe from both bishops and priests alike.

Of course, one of the primary reasons for the ecclesial endorsement of credit unions, whether it comes from The Vatican, Church of England or any other Christian denomination, has to do with addressing the injustice associated with usury—lending money in desperate times that carries an exorbitant rate of interest. With social justice and social responsibility serving as fundamental tenets to the Gospels and Christianity, credit unions are the perfect solution to offset usury in the form of payday lenders.

Seeing The Archbishop of Canterbury set in motion a process intended to foster credit unions growth is in my humble opinion not only an exercise of good conscience but also a way for the Church to put the values of what it preaches into action. It’s one way to walk the talk, and it should be loudly applauded by all cooperators, especially within the credit union sector.

By the way, the Church of England is also planning to launch a credit union of its own, possibly in partnership with the Church of Scotland. It would lend to members of the clergy and become a source of expertise on the credit union sector.

Seems the news for credit unions in Europe couldn’t get any better! Or, could it? Maybe so, but only if such inspiration could now somehow make its way to Italy and Vatican City!

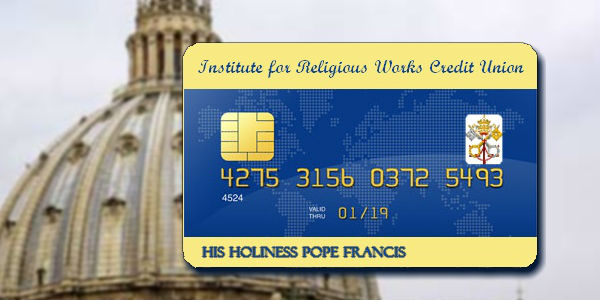

Although The Vatican may not be considering ways at this time to challenge the wrong-doings of payday lenders, it has its own migraine to contend with in the form of corruption at The Vatican Bank, otherwise known as the Institute for Religious Works.

News sources covering The Vatican recently reported that Monsignor Nunzio Scarano was arrested after allegedly trying to bring 20 million euros in cash into Italy from Switzerland aboard an Italian government plane, in an attempt to circumvent laws on importing cash. The money allegedly belonged to three brothers from an Italian family of shipping magnates.

Msgr. Scarano allegedly masterminded the plot with the help of a broker, Giovanni Carenzio, and an Italian secret service agent, Giovanni Maria Zito, who was suspended three months ago from Aisi, Italy’s domestic intelligence agency.

The arrests came just two days after Pope Francis appointed a special commission to oversee the Vatican’s scandal-plagued bank, described by Forbes Magazine as, “the most secret bank in the world.”

Although the Vatican bank does not lend money but manages assets of some seven billion euros held by Vatican departments, Catholic Charities, and priests and nuns from around the world, perhaps the time has come to scrap its business model and have it replaced by what else—a credit union.

Imagine how the cooperative principles of open and voluntary membership; democratic control; non-discrimination; service to members; distribution to members; building financial stability; ongoing education; cooperation with other cooperatives; and, social responsibility might resonate in an environment that, like the Church of England, also embraces the teachings of the Gospels as a code of conduct. The Church of England is getting it right. Think it’s time for The Vatican to do the same?

By the way, if you want to hear more on this topic, check out what our fellow-cooperator, Andrew McLeod, has to say in his book, Holy Cooperation!

Finally, if we add icing to the cake by including the cooperative values of Equity, Equality, Self-Help, Democracy, and Solidarity, it becomes all the more evident that a credit union model would be a perfect replacement for The Institute for Religious Works.

Now, if only the proposal set forth by The Archbishop of Canterbury could spark some new insights behind the walls of The Vatican, particularly in the mind of the Jesuit who finds himself Pope, the idea of a Papal Credit Union might not be that far fetched.

Imagine if news suddenly broke from The Vatican that Pope Francis decided to start a credit union—The Pope’s Credit Union!

So . . . how do we now go about planting the seeds?