8 social media pitfalls & opportunities for credit unions

We’ve all heard this: “More social media engagement is a must! More, more, more. Now, now, now.”

That’s fine and dandy as a concept, but most marketers at credit unions are already spread thin. Social media has typically gotten shortchanged as a result. Financial institutions have, for the most part, gotten away with it, largely because finances were one topic too personal or too important for most customers to interact with on social media.

That has officially changed.

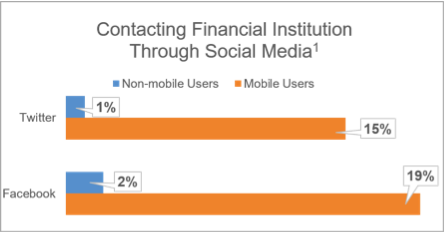

Since mobile is rising faster than any other banking channel, these numbers are quite eye-opening. In the eye-popping department, these same people interacting with their institution through social media are younger, more affluent, and are more satisfied than those who don’t.1

Thankfully, there are ample ways to make social media magic happen for your credit union.

Before we get to the top 4 ways to maximize your social ROI, it’s important to recognize the top 4 social media pitfalls. (It’s OK if some are painfully familiar!)

Top 4 Social Media Pitfalls to Avoid

- Heaping it onto an already full plate. This is where every company starts, and it rarely succeeds. The conundrum is the amount of work needed is not enough for a full-time position. Those 10-15 hours a week are vitally important, though. But for the already-busy employee, social media will be the first tasks to get shortchanged as they try to keep up with their work demands. You can count on that as much as you can Kim Kardashian posting a selfie.

- Weekend darkness. A lot happens on the weekend. If your social media duties are handled by an employee who doesn’t work (or has limited hours) on weekends, well, you see the problem.

- Handing it over to the young newbie. It’s very tempting. Which is why so many companies pass off the social media duties to an intern or the young new hire just out of college. After all, they use social media like oxygen right! While they get social media, they may not get your business yet. Or your members’ wants and needs, or your comprehensive marketing strategy, or your strategic roadmap to consider in all communications. Handing this responsibility to someone because they know how to use the tool is like giving someone a hammer and expecting them to build you a condo.

- Making blatant sales pitches. These don’t go over well on social media. Especially if you post infrequently, yet when you do it’s an offer about a promotional loan or savings rate. That’ll be crickets you hear in the background. This also prevents you from building an audience, because the audience’s first impression will peg you as a salesman and never follow you in the first place.

Top 4 Opportunities to Improve Your Social Media

You may be on to the first two already, but you might be surprised by the last two.

- Get the right tools. If you’re not using a social media management platform, you should start. Hootsuite is the most commonly used. The ability to schedule posts (on all your social outlets in one dashboard) as frequently and far in advance as you want makes it easy to carve enough time to schedule dozens of posts. Hootsuite’s free version is fine to start, but as little as $10/mo nets more functionality and the ability to have multiple users using the platform. If you’re doing anything internally, your employees absolutely need this most basic of tools.

- At least consider farming out your social media. You may or may not end up doing so, but it is seriously worth considering. A reputable firm can provide the content and expertise for less than an employee salary, and they’re experts. There are downsides, like concerns over getting your voice or complexity of the industry. Regardless, through the process of vetting firms (don’t go with an individual, otherwise you’d be better off hiring internally) you’ll learn what you want and don’t want, and be able to pinpoint a budgetary number on the value.

- Leverage your existing partnerships/vendors. Use (and choose) your third-party vendors wisely. Some may have a social media presence you could tap into, even if it’s just re-tweeting something of value. There are ways to go beyond this, and here’s where your biggest social media opportunity may be. For example, at Buzz Points (a debit/credit card rewards program) we generate social media content for our credit union clients so all they have to do is cut and paste. We don’t charge for this (or roll it into program cost) since we stand to benefit from enrollment and engagement as much as the credit union does. So you gain a team of social media experts just as incentivized as you are, at no additional cost. Icing on the cake: the type of content fares better on social media than most that a financial institution would typically generate.

- Do what JC does. Not that JC. Follow @JillCastilla on Twitter and learn from her. This CEO of a small community bank in Oklahoma is the best example of a community financial institution absolutely nailing it on Twitter. She’s very community focused, positive, helpful, and rarely talking (directly) about her institution. In the process she’s built a huge following, created a to-die-for image/reputation for her institution, and even (gasp) drive business right from Twitter.

Of course, there are plenty of experts to learn from. Make it a point to read an article every couple weeks to keep your skills fresh. Convince and Convert, Content Marketing Institute, and Marketing Sherpa are all great outlets to find best practices, stats, and insights to build your know-how.

1Gallup, “U.S. Retail Banking Study,” 2014