Financial strategy starts with the member

In the wake of the Silicon Valley Bank (SBV) collapse, many financial institutions are reconfirming their financial strategy; looking for cracks in their risk management armor. Although SVB’s business model was unique, particularly when compared to credit unions, it is prudent to reassess and confirm your financial strategy. Like all strategy developed in the credit union movement, it should start with the member, understanding your members’ current and future needs.

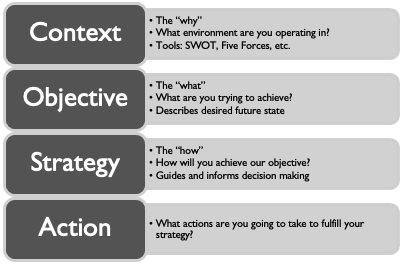

The “good strategy” framework has four parts 1) context, 2) objective, 3) strategy and 4) action. I developed the good strategy framework to structure the strategy development process into simple components that enables everyone, at all positions, to participate in and contribute to the development of their organization’s strategy.

Context

The framework starts with context, which is the “why” that supports your strategy. Context captures the forces and trends defining the environment you are operating in. When we are developing a member engagement strategy the context includes member feedback, needs and expectations, competitive threats, emerging technology, etc. When developing financial strategy sometimes there is the tendency to jump right to actions i.e., participation lending or product pricing. However, our financial strategy should also start with our member. It is the profile and behavior of our membership that will inform the objectives and strategies.

Internal context

The context of your financial strategy should include both internal and external factors. The internal factors start with understanding whom you serve, their needs, expectations and behaviors. For example, share deposit behavior will likely differ between credit unions serving school employees versus technology firm employees. School employees are paid throughout the school year, but not during the summer when school is out, when they are likely to use more of their reserve savings. However, technology firm employees are paid throughout the year and likely have higher deposits due to their higher levels of compensation. Therefore, the seasonal fluctuations in deposit in-flows and out-flows will differ.

Understanding your membership and their behavior, should play a major part in how you determine the liquidity needs of your organization throughout the year, which will influence your product offerings (i.e., design, pricing) and investment decisions (i.e., short- and long-term duration mix).

The profile of your membership and the effectiveness of your participation strategy (i.e., your credit union’s ability to capture the member’s full financial relationship) should also be considered in your financial strategy. For instance, if your members primarily leverage the credit union for checking and savings accounts, but not for their borrowing needs, then your financial strategy needs to include strategies to acquire assets and yield through third parties i.e., participation loans, investments, etc. In addition, the credit profile of your members and their ability to repay will inform your credit union’s credit risk appetite and inform your underwriting process.

Finally, the current and expected financial position of your credit union should also be included in the context of developing your financial strategy. Do you need to build up your capital reserves? Are your operating expenses under control and trending in the right direction? How healthy is your net interest margin? The answers to these questions will inform your financial strategy and should influence the other strategies in your credit union.

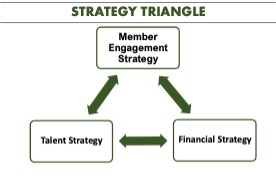

There are three enterprise level strategies that need to be aligned and influence each other, I refer to this as the Strategy Triangle. For example, major investment in talent should improve member engagement, but it will also increase operating expenses, therefore there must be a balance between the invest in talent and the expected financial returns to the membership. Each component of the strategy triangle influences the others.

External context

Credit union financial performance is heavily impacted by external factors e.g., interest rate environment, economic cycle, etc. Clarifying the current and expected changes of these external factors enables you to plan understanding the economic impact of your decisions and to develop a plan B, or C, for when the context changes i.e., a sudden change in economic climate.

In early 2022, no one anticipated the Federal Reserve Bank would raise interest rates faster than at any time in our country’s history. A robust financial strategy accounts for current conditions and alternative scenarios, enabling a quick pivot to protect the members and their assets. Also note that although the external factors are in financial terms (e.g., interest rates, inflation, and unemployment rate), it is the impact on your members and their behavior that you should focus on.

When unemployment rises, how does this impact your membership? Do their hours get cut (manufacturing jobs) or are they insulated and less impacted (government jobs)? How sensitive are your members to interest rate increases or growing inflation? Understanding your membership will determine how you can best serve them in favorable and unfavorable economic cycles, which will inform your financial strategy and the tactics you deploy. Therefore, financial strategy, like all credit union strategy, starts with the member.

Objective

Once you have a good understanding of your context, then you can set clear mid- to long-term objectives for your financial strategy. An objective is your “what,” what do you want to achieve, typically over the next 3-7 year time horizon. Objectives can be broad e.g., rebuild capital, enduring financial strength, and they can be accompanied by very specific goals e.g., achieve a 1% ROA, maintain a capital ratio above 9%.

Strategy

Strategy is the “how.” How do you plan to achieve your objective? There is typically more than one way to achieve an objective, therefore it is important that your strategy clarify how you want your team to make decisions and what options are off the table. A helpful example I use is my brother and I both have the objective of losing 20 pounds, he decides to adopt a low-carb diet, while I decide to train for a marathon. We have the same objective, but have different strategies.

Using a credit union example, one strategy to achieve the objective “enduring financial strength” could be “member-friendly fees.” This strategy would clarify that your approach to fees is to be 50th percentile in the market and include a preference to offer fee-based, value-add services that members understand and accept for the convenience of the service.

This strategy provides guidance that fees are ok but that you want to remain in the middle of the market, keeping costs reasonable and beneficial for your members. It also allows for creative service offerings that generate fee income that the member understands and accepts when choosing the service (e.g., insurance products, wires). This strategy also clearly says you will not have the highest fees in the market and we do not hide or surprise members with fees. This provides leaders clarity in how to make decisions that align with the credit union’s strategy, while leaving room for them to be creative and generate ideas to serve members.

Action

Finally, the actions are the changes that you plan to complete to fulfill the strategy. Examples include reassess overdraft fee policies and the creation of a new insurance product that aligns with the member-friendly fees strategy.

Although all members of your team can participate at any step of the good strategy framework, the actions step is where you will see the most energy and participation. The power of the framework is that now all actions are informed and align to the objectives and strategies determined by your leadership, which started with the member at the center of the process … versus starting from a blank sheet of paper which leads to disjointed efforts across the credit union.

The good strategy framework enables alignment across the enterprise. Your actions work to fulfill your strategies to achieve your objectives based on the context you are operating in.

Start with the member

As you reassess your financial strategy, remember that understanding your membership is equally as important as understanding the external economic environment. Make sure you make changes and adjustments given your full context, both the internal and external factors. The context explains the “why” for your strategy. Developing your financial strategy by starting with the member ensures you always remain focused on what is most important, serving your members and improving their financial well-being.

All good strategy starts with the member.