Ideal location too big for your branch footprint? 3 creative solutions

As the credit union industry moves to more conversational and relationship-based staffing models, the average branch footprint is shrinking.

But rental spaces and properties for sale in prime locations are not.

So what can you do when your branch footprint is much smaller than available spaces? Moving to a suboptimal location is one option, but I’d like to share a few case studies of clients making great use of their excess space.

- Contact Center

Have a contact center located in a branch solves several problems.

For one, it’s a very productive use of excess space. Especially if your credit union is growing and you are running out of space at your main contact center.

It also eases staffing shortages by helping you tap into new labor markets that would otherwise have a longer commute to your main contact center.

And one not-so-obvious benefit – it can help ease member ITM adoption.

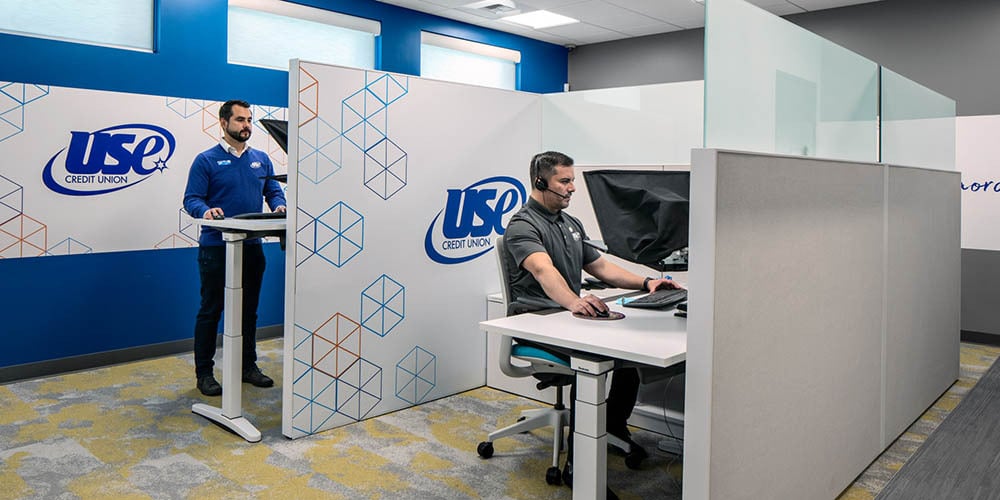

USE Credit Union discovered this last benefit with their new Mission Valley branch, which features a back-of-house ITM contact center and a hybrid staffing model where employees will float between front and back of house.

Members sometimes believed that this new technology was taking away jobs and pushing out the branch staff they were familiar with. But seeing familiar faces on screen broke down many of the barriers that members had towards adopting ITMs.

“Members are hesitant at first, but it’s the relationships that staff have built that get members to try the ITMs. And once they try it, they typically like it,” said Amber Fielder, VP of Marketing at USE Credit Union.

To learn more about this project and including a contact center within a branch, read the USE Credit Union case study.

- Partner Business

When CBC Federal Credit Union shifted to a new conversational staffing model, their footprint shrank significantly. Yet their Camarillo, CA branch was in an ideal location and the credit union did not want to give that up.

Their solution was to partner with Dunkin, and our design-build team created a vibrant community space in a shared lobby between CBC and Dunkin. The end result is an unprecedently level of branch traffic, branch exposure and new account openings, and increased non-investment income from a revenue share with Dunkin. CBC has also found that the shared branch functions as a conduit for recruiting, giving the credit union an advantage in a tight labor market.

You can learn more by reading the case study here.

Fibre Federal Credit Union is also utilizing this strategy by partnering with Red Leaf Coffee throughout their branch network. Like CBC, Fibre has seen the partnership bring in increased branch traffic.

- Business Incubator

Do you want to develop relationships with the local business community and capture that market?

A business incubator can be an excellent use of space.

Armco Credit Union did just this for their newest branch in Mars, PA. One of their objectives was to expose more organizations to the credit union movement and expand their SEG base, and the area has a thriving small business landscape. The retail space is actually the smallest component of the building, with the majority of the space taken up by a large community room that functions as an event space and small business incubator. This space is being actively used by local businesses who are developing relationships with the credit union.

Read the Armco Credit Union case study here.

Another successful example is Chrome Credit Union. We developed and branded their community space as a business incubator, and this led to local businesses actively using the space. As a result, Chrome has seen a significant increase in small business relationships.

Unlimited Possibilities

Hopefully these three examples show why the mismatch between branch footprint and available real estate is an opportunity rather than a problem. And these are just a few examples out of limitless possibilities.

We’d love to hear from you, whether it’s a new idea for using excess space or you want to kick off your own branch transformation project. Fill out the form below to start a conversation today!