Strategies for building your high performance tribe dream team

Creating a vision of greatness for your credit union starts with your most important asset—your people!

Their attitudes, productivity and climate in which they work and how well they are lead and managed all influence your credit unions success in serving members effectively.

Great organizations foster a team environment and are the sum total of the experiences and skills that their people bring to the workplace to achieve their mission and business goals.

Building high performance work teams in your credit union involves dual commitment from both staff and leadership.

What does Team really mean? Team is really a unit for which:

Together

Everyone

Achieves

In our fast paced financial services industry in which credit unions operate it is impossible for any one individual in the work place to master the complexities of the work world and the challenges of change.

The new mantra in the business workplace is “The Task is the Boss”!

High performing multi skilled staff work teams can have an impact on productivity in a much greater way than any individual. Hence the team slogan “All of us working together are better than any one of us working alone”.

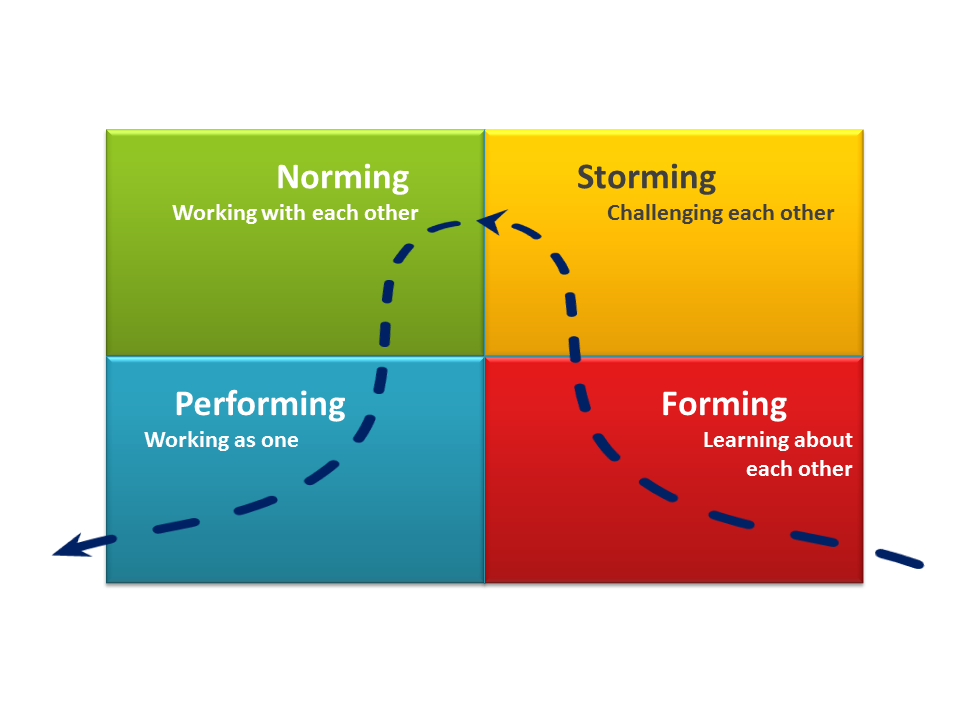

In developing a high performance team, Credit Union leaders must realize that this is no easy task and all groups must go through Four Phases for cohesion: Forming, Storming, Norming and Performing.

Forming is the first stage of team building and involves the behavior of individuals desire to be accepted by others. Team members behave independently and key element of this stage is that all team members get to know each other, agree on goals and understand the task at hand.

Storming is the stage where different ideas from individuals compete for consideration. Team members begin to open up to each other and challenge each others ideas and perspectives. Resolution to issues is part of the development this stage of team development and can be contentious and painful to members who are adverse to conflict. Each team member practices tolerance and patience for the good of the group. Resolution of individual differences is the key growth element in this stage of team development.

Norming. In this phase of development the team focuses on one goal and come to a plan for focusing on the task needed for achievement. In this stage all team members forgo their individual preferences and agree with each other in order to make the team properly function. In this stage all team members commit to a shared responsibility to work toward the success of the teams goals.

Performing. When teams reach the performing stage they are able to function as a high performing team that gets the job done without conflict and limited supervision. This is the high productivity stage where team members feel competent and are motivated by a collective accomplishment of achieving goals.

High performing teams also share come common characteristics that help to maintain healthy team member relationships.

Your credit union team must have a shared and meaningful purpose of what they do. The credit union people helping people philosophy is a driver and reason for their work.

The business objectives of the credit union must be in alignment with the goals of the team. Each team member must be clear on their roles and how they benefit the team.

Each team member must possess complimentary skills, the right combination of experience, knowledge and competencies to perform effectively.

The team must also commit to their Team Charter where the ground rules are agreed upon for appropriate behaviors and actions, the scope of the teams responsibility in decision making and strategies to ensure that commitments are kept.

To ensure that your credit unions team is functioning and performing at its highest levels leadership must foster a climate where there is a high degree of trust among team members, no fear of conflict, a commitment and accountability by all team members and an attention to and focus on achieving results.

Your credit unions team is only as strong as its members or in summary to use one of nature s analogies-The Strength of the Pack is the Wolf and the Strength of the Wolf is the Pack!

Advantages of Working in a Team Environment

1) More input leads to better ideas and decisions

2) Output is higher quality

3) Everyone is involved in the process

4) Ownership and buy in by members increases

5) A circle of communication is widened

6) Shared information increases learning

7) Opportunity to draw in individuals strengths increases

8) Ability to compensate for individual weaknesses is provided

9) A sense of security is provided

10)Personal relationships and trust develop