Uphill both ways: The battle against delinquencies and collections

As interest rates continue to rise, credit unions are likely to experience an ongoing rise in delinquencies and collections. In this economy, this can be a significant challenge for credit unions, as delinquencies and collections impact your bottom line and ability to continue lending to members. Therefore, it’s essential to implement strategic solutions to combat and offset these conditions.

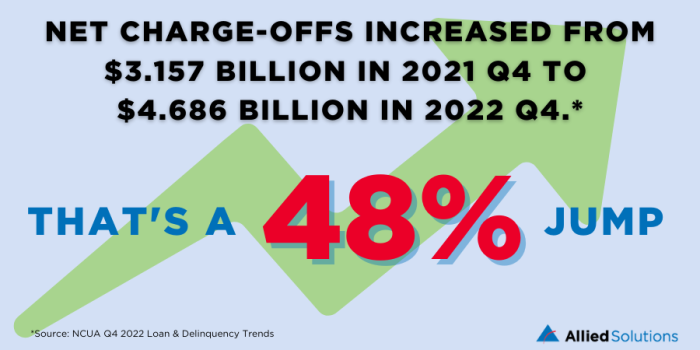

Based on the NCUA Q4 2022 Loan & Delinquency Trends, there was an increase in net charge-offs from $3.157 billion in 2021 Q4 to $4.686 billion in 2022 Q4. That’s a significant 48% increase.

Higher loan losses can lead to reduced profitability for credit unions and may also signal economic weakness or instability. Additionally, higher loan losses can make it more difficult for credit unions to extend credit to borrowers, which could have a negative impact on member spending and economic growth. This increase in net charge-offs in 2022 Q4 is a cause for concern for credit unions and the broader economy. It’s difficult to predict with any amount certainty what will happen in 2023, but credit unions may need to take steps to reduce their exposure to loan losses and be prepared for a persistent weakening economy.

Here are 5 ways to reduce your exposure to loan losses:

- Implement sound underwriting practices: Strict underwriting standards help to ensure that you are only lending to borrowers who can repay their loans. This includes analyzing a borrower’s credit history, debt-to-income ratio, and collateral to determine the likelihood of default.

- Diversify the loan portfolio: By diversifying your loan portfolio, you can reduce your exposure to any one particular type of loan. This can help mitigate the impact of any losses that may arise in a particular loan segment.

- Monitor loans regularly: Have processes in place to monitor loans regularly to identify any potential problems early. This can include reviewing borrower financial statements, tracking loan payments, and following up on delinquent accounts.

- Use loan loss reserves: Strategically and compliantly, set aside funds in a loan loss reserve account to cover potential losses. This can help protect your financial position in the event of loan losses.

- Offer loan modifications: In the event that a borrower is experiencing financial difficulties, offer loan modifications to help them stay current on their payments. This can include extending the loan term or deferring payments.

Be collection-ready

Identify ways to streamline the collections process. This can include using collections technology to automate collections and provide members with various payment options, such as online payments or automatic withdrawals. It’s essential to have a dedicated collections team that can work with members to create customized repayment plans and negotiate settlements when necessary. A right-fit solution aims to improve the efficiency of collections for credit unions. It should offer a complete, browser-based collection software system that provides essential tools for managing delinquent loans and accounts, claims, and recovery services. The solution should function as a standalone service or can be integrated through the client portal to achieve the credit union’s unique goals. A full spectrum management program needs to cover all aspects of the critical process without adding significant overhead.

Furthermore, consider partnering for collections outsourcing to help collect past-due amounts. Lean on the experts that have the proficiency and resources to collect outstanding debts effectively, freeing up credit union staff to focus on other areas of the business. By doing so, the administrative burden of servicing collections is reduced, delinquency rates are improved, and borrowers’ delinquency patterns are rehabilitated. This team should serve as a first-party, extended business office to handle pre-charge-off and post-charge-off services, maximizing returns. The aged post-agency and rehabilitated recovery services can turn charged-off debt into capital and delinquent accounts into prime members.

Generally speaking, delinquencies and collections can be a significant challenge for credit unions, especially in a market facing an uphill battle with interest rates. By implementing these strategic solutions, credit unions can continue to thrive and provide valuable services to their members.