7 Tips for Credit Unions in Social Media

(Note: this this post focuses exclusively on credit unions-stay tuned for Part 2 on banks)

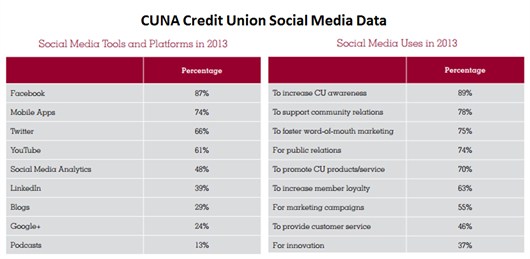

I’m certain we’ve all heard the logic, “everyone else is doing it, so shouldn’t you?” I’m equally certain that credit unions not involved in social media marketing have recently thought this. According to a 2013 poll by CUNA Mutual Group, 87% of credit unions are investing time and money in Facebook as part of their marketing strategy. Even amongst those using social media, though, it is likely that there is room for improvement.

So to credit unions using or looking to use social media, it’s time to go back to the basics. Remember, it’s not just about being a part of the social media sphere-it’s about what you do with it. And because I think many credit unions could do more, I’ve compiled a list of 7 tips on how credit unions should approach social media marketing in a way that compliments their overall objectives.

1. Set Objectives

Credit unions are member-focused and aim to have more personal relationships with members. One way you, a credit union, can achieve this outside the branch is by establishing a community through social media. When setting objectives, you should focus on utilizing social media to further your critical business objectives such as member acquisition, community engagement, and member service.

Put simply, you should align social media with your credit union’s strategic goals. Build member relationships through social media interaction, provide prompt attention for member issues, and engage readers in order to acquire new members. Campaigns with a purpose are the most successful.

2. Develop a Plan

Don’t just create a Facebook and a Twitter account and expect to see immediate results. In order to gain a following online, you need a plan of action. Think about which social media channels are best, and consider who your audience is. According to Pew Research Center, 67% of online adults use social networking sites, so a majority of your members are likely online. Who does your credit union cater to? What social media channels are your members on? Do your research, and you’ll be rewarded.

continue reading »