Credit unions are failing SMBs

The 4,800 credit unions in the USA are missing out on an opportunity to better serve their small- to medium-sized business (SMB) members. With over 140 million Americans as members of credit unions, it is estimated that at least 11 million of the US’s 32 million SMBs are members – and credit unions are not meeting their working capital needs.

American families and children rely on our nation of SMBs for the job creation and productivity to put food on the table, gain education, purchase a family home and live in safety and comfort. Yet SMBs working capital needs are attempting to be met instead by banks and the pernicious and predatory fintech lenders charging up to and beyond 80% interest rates.

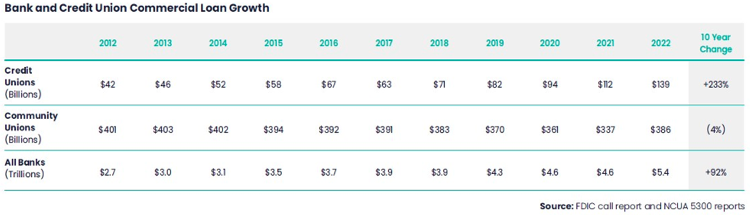

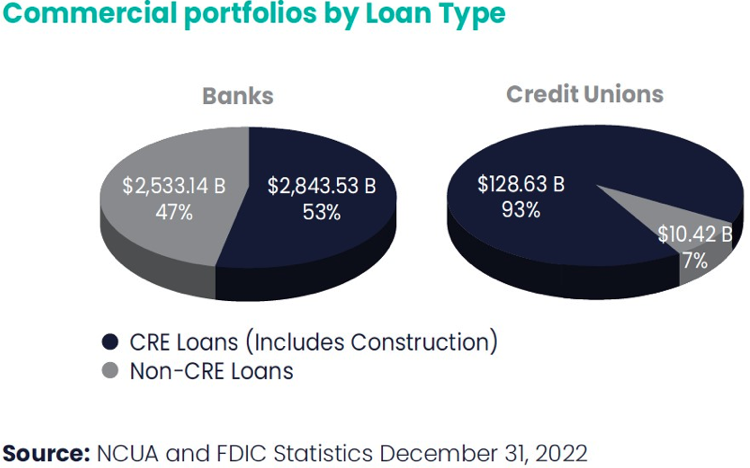

In 2022, credit union lending was only a tiny 2.5% of banks’ $5.4 trillion annual total commercial lending. Added to this, current credit union commercial lending is also heavily overweighted in conservative bricks & mortar real estate compared to the banks.

Credit unions are currently suffering an auto-lending decrease of over 28% over the last 12-months, meaning efficient loan book growth and a determined commitment to helping SMB members be better off is a massive opportunity for credit union leaders. Can the credit union movement mobilize and strategically position themselves to steal $100 bill of SMB loans from banks and fintechs?

Post-pandemic loan environment – where are the credit unions?

Like all economies around the world, the American economy continues to feel the pinch of a post pandemic recovery, rising interest rates and recessionary pressures. For myself—and most people in business—it’s hard to remember a time of ‘business-as-usual’ before Covid-19. Now over three years on from the beginning of the pandemic, it’s clear to see how much the world around us has been changed by the global health crisis. Sadly, for SMBs, the challenges of this new reality are particularly pronounced. The combination of growing economic uncertainty, supply chain disruption and limited government support has created a nightmare scenario for SMBs, which has left many of them fighting for their business’ lives.

Loan rejections and prolonged borrowing approvals have become the norm — squeezing small business growth and jeopardizing stability as the economy slows and the banking crisis injects more uncertainty. Traditional banks have grown more nervous about lending after the failure of Silicon Valley Bank and Signature Bank and these jitters sit atop existing concerns about the economic downturn, and the effect that higher interest rates have on borrowers’ ability to repay loans.

Roughly 47% of banks surveyed by the Fed after the seizure of Silicon Valley Bank and Signature Bank said they had tightened lending standards for small businesses — those with annual sales of less than $50 million — during the first three months of the year. That’s up from about 22% last summer.

A vast majority (77%) of small business owners say they’re now concerned about their ability to access capital, according to a Goldman Sachs 10,000 Small Business Voices survey, compared to a year ago when 77% said they were confident.

Small to medium sized businesses now need even more support from financial institutions and at any given time up to 50% of SMBs are seeking working capital to meet operating expenses, manage expansion, seasonality, tax obligations, etc. Good SMBs need frictionless access to working capital at fair rates. To ensure this happens, the financial sector needs to prioritize and leverage digital transformation and the power of real-time data into important decision-making processes, especially when it comes to access to the vital working capital needs of SMBs.

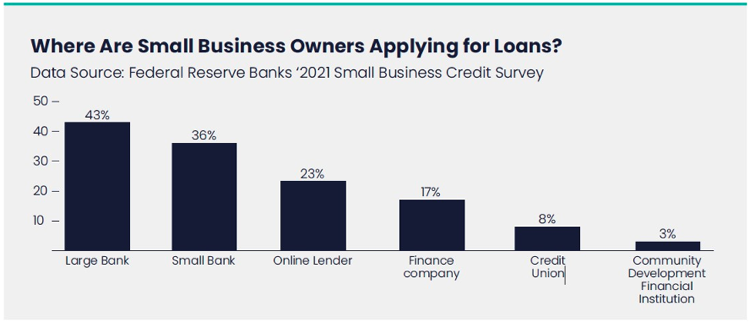

With over 32 million SMBs in the US (99% of commercial entities who employ 62% of the workforce), of those that apply for financing, 69% either received no financing or got less than they sought. Despite SMBs’ perceptions of credit unions as trustworthy, poor underwriting experiences are spurring many businesses to turn to other options.

Other banks and neobanks top the list of providers SMBs would consider switching current finance partners to, followed by merchant networks, fintechs, big tech and a range of other partners. Fintechs have positioned to underwrite the smaller <$250K working capital loans that are the fuel and lifeblood for so many SMBs, however the price for ease and convenience is high for SMBs in the USA with the interest rate charges from fintechs ranging from 20% to as high as 60-80% and more.

Unfortunately, these new concerns are only compounding an existing issue, which I’ve seen disproportionately affect smaller businesses for some time. Simply put, Covid-19 has made it even harder for SMBs to receive working capital when they really need it. The ramifications of this issue are serious, especially as countries around the world strive for progress and economic recovery. Now, there’s a clear need for platforms that overcome this problem in the business world, thankfully, such solutions might already be available.

Facing the Facts – old world manual origination processes do not meet SMBs needs

Let’s start with the basics: before anyone had ever encountered Covid-19, SMBs still faced considerable difficulty accessing loans for working capital compared to their larger counterparts. To put this into context, less than 15% of SMBs had access to the resources they needed to grow and create wealth before Covid-19. Similarly, the World Bank has previously estimated the unmet financing need of SMBs to be $5.2 trillion annually, approximately 1.5 times bigger than the current lending market.

Why is this the case? Well, the methods currently used to underwrite SMB credit are largely to blame. Despite all the technological advancements of the past four decades, SMB credit underwriting still mainly relies on long-winded, people-heavy manual processes to gather, input and assess business, credit and financial information, which can be first traced back to the 1980’s. These systems may have worked for companies back then but are simply no longer suited to the demands and speed of modern business, especially within the context of our current economic climate. Therefore, there’s a huge national incentive to ensure such businesses have the tools needed to galvanize growth back to pre-pandemic levels.

Taking the next important steps – can credit unions step up and lead for US SMBs?

Thankfully, there’s now widespread consensus regarding what these tools would look like, and how they would help to make a difference. Moving forward, SMBs need to be supported by modern easy and fast technology solutions, 24-7 x 365, which can speed up the application process and leverage API data sources when making instant decisions. Personally, I think this potential was best explained by consultancy leader, Deloitte, who declared such products as ‘key solutions to current lending gaps”. These systems will soon help to make SMB lending more frictionless, and perhaps most importantly will dramatically shorten the time frame on expected decisions. From weeks and months down to days and even minutes.

Better still, it’s my belief that the introduction of these systems won’t only benefit SMBs. Instead, by leveraging real-time data within the credit decisioning process, modern solutions can help credit unions to routinely make more accurate and reliable lending decisions whomever is applying, when assessing SMB credit applicants. With credit unions looking to balance efficient loan-book growth as well as limit risk within their decision-making processes, they must also meet their regulatory reporting requirements within the CFPB 1071 regulations. Considering other market pressures, such digital lending products are an ideal solution if they bring accurate digital efficiency now, and scale loan book growth next.

Therefore, it’s little surprise to hear there’s now considerable buy-in across the market for such solutions. However, as with any major technological advancement within an industry, I believe there needs to be a transitionary period as solutions are onboarded, which will require action from both sides of the equation. Thankfully, this should be achievable in a relatively short time frame, which in turn will provide the US economy with the support needed to foster significant economic recovery.

As a SMB owner myself, I’m committed to supporting this drive and it’s clear to me that now is the time for solutions that provide access to real-time, orchestrated SMB loan origination, data points, and automated decisioning. Adopting these solutions will help SMBs to gain access to a more practical digital application process and help lenders to make more accurate lending decisions within a capital efficient and technologically advanced framework.

Nobody has enjoyed the recent economic upheavals, but with the most disruptive elements of the global health crisis now seemingly in the rearview, it’s time to assess how we can go about building a world that works better for all businesses, especially SMBs. Thankfully, data-led digital technologies can make this ambition a reality. The priority now is to get these solutions onboarded as quickly and efficiently as possible, a goal that the credit union movement must decide if it wants to LEAD or LOSE in.