2019 Market Disconnect – Deposit pricing strategy

How to stay competitive in a disconnected market without getting burned

As we enter the fall season and the 11th anniversary of the Lehman collapse, the overnight funding markets have come under stress. The common themes behind the dislocation are corporate taxes, mid-month treasury auctions, global uncertainty, quarter-end and the upcoming Federal Open Market Committee meeting. On September 17th, the Federal Reserve injected $75B of repo into the markets to combat the situation. The strategy helped calm the markets as overnight repo rates on the 18th traded down in the 2.40% range from as high as 10% the day prior. However, the Fed Funds rate traded above the Fed Target rate signaling the Fed will need to take additional action to control policy rate (see Figure 1). Although there is stress in overnight markets, the economy as a whole is in better shape than it was in 2008.

Figure 1

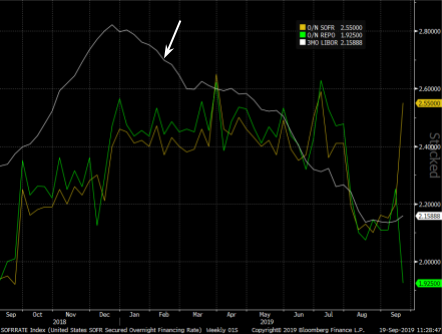

In addition, the Secured Overnight Financing Rate (SOFR) followed suit and spiked at 5.25, up 3.25 from the prior week (see Figure 2). The concern, however, is that there is not enough liquidity to meet the funding demands of the markets and that extended increased rates will have a negative effect on the broader economy. The markets are looking for confirmation from the central bank that they will provide necessary liquidity to support the markets’ demands.

Figure 2

All eyes are on the Federal Open Market Committee to see if additional tools will be enacted to remove the pressure to provide liquidity and stabilize rates. The large institutions are still using LIBOR-based models to match assets, which was not disconnected like the Fed Funds and/or SOFR. However, depending on funding structures, they may be at a competitive disadvantage to overnight funding.

Through the recent repo and SOFR market turbulence, LIBOR has remained much less volatile (see Figure 3).

Figure 3

On September 18th, the Fed made its second rate cut of the year to 1.75% – 2%, and said “a more extensive sequence of cuts” was on the table, if appropriate. They also lowered the IOER rate to 1.80%. The Fed appears to be reluctant to take aggressive measures, but has been slowly moving in that direction over the past several months with two rate cuts and bringing back repo operations.

It remains to be seen if the Fed resuming overnight repo operations after a decade is a sign of more trouble in funding markets ahead, and a potential return to some type of outright securities purchases through a QE-type program on the horizon. Or, if it’s nothing more than a return to using a pre Lehman tool for providing market liquidity and the “big picture” market calm continuing.

CONCLUSION

Liquidity is on the forefront of concern again. For financial institutions, when structuring wholesale funding options, it is critical to construct stable sources that are predictable though varying market conditions. The key components are to establish funding agreements, pricing indices within a structured bandwidth to avoid pricing dislocations as we are currently experiencing and diversification to avoid concentration. The goal is to stabilize funding levels through diversified sources while avoiding market noise.