3 steps to building increased member loyalty

In today’s resource constrained environment many credit unions are faced with the dilemma of determining the best allocation for their marketing resources. The primary decision is whether to continue to focus on expanding the member base or to concentrate on deepening the relationships of existing members. Of course both are critical to the continued growth of your CU. However, many CUs are now beginning to see the benefits of creating a loyalty program that leverages the value of existing member relationships. By offering additional CU services to existing members in a thoughtful, needs based approach many CUs are improving their revenue growth through their current members.

Designing and implementing a loyalty program can be difficult; however, following these three simple steps can increase the chances of implementing a successful campaign:

- Know your members and what they expect from you

- Design a targeted strategy with clear objectives

- Put the resources in place to flawlessly execute your strategy

Know your members

Before designing a loyalty program it is important to collect and analyze all you know about members and what is important to them. If a centralized marketing database isn’t part of your toolkit, this information can be collected from a variety of sources within your organization.

For example, all member facing associates can be an invaluable source for information about member expectations. It’s possible to run internal focus groups and pull together antidotal information gathered from members. This focus group should include inbound service representatives, mortgage loan sales and branch personnel.

Another option for gathering member information comes from companies that provide a one-time analysis of your membership that includes; a segmentation scheme, member HH revenue value, and a next product predictability index for each member. These one-time snapshots can be rolled into an ongoing database that is updated on a quarterly or monthly basis.

CUNA Research is another potential resource for learning more about membership. CUNA offers research that focuses on defined marketing opportunities, one of them being the factors that contribute to increasing member loyalty. In addition to this customized primary research you can spend less for syndicated third party research. It not as accurate as primary research, but it can help control your budget. Be careful many time syndicated research will not be accurate if you are in an atypical marketplace.

If a marketing database is available, begin looking at member behavior and correlate segment characteristics with specific product usage behaviors. This provides insights into important product attributes and determining the next product to offer. It is important to begin developing a methodology for clustering members into meaningful groups with similar characteristics when developing a credit union wide loyalty program.

Design a targeted strategy with clear objectives

To be effective, a loyalty program must contain relevant messaging, a personalized call to action and offer members appropriate CU services. Interactions with members can be across many channels including your website, telephone, live chat, direct mail, marketing materials, social media and “the old fashioned way” through service associates.

When creating the messaging, it is important to keep a long term perspective in mind – meaning it’s the overall member journey that matters more than individual member interactions. Focus efforts and positioning on enhancing the member’s perceptions of their journey with their credit union.

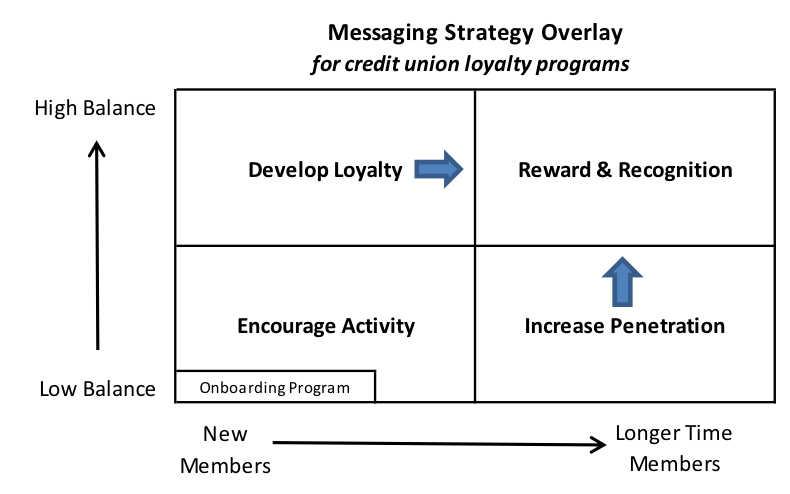

If you don’t have a marketing database or member segmentation there is a process for using your CU’s core operating system to create loyalty program segments. If you can identify how long a member has been with you and their balance you can use these data points to create effective loyalty program segments.

Using this methodology you can gather members into 5 distinct categories for the purposes of strategy development and message (see illustration below). In each of these 5 categories, members are defined and clustered by their behaviors at your institution.

An organized onboarding program captures new members and introduces them to the credit union’s brand and provides opportunities for members to explore additional (and relevant) products.

Lower balance members are broken down into two groups; newer members and those that have been with the credit union for a longer period of time. The objective for both is similar but the messaging to each is distinctly different based on their timeline and product usage behavior with the CU.

The same is true with higher balance members; those with a shorter timeline should be offered value enhancements, which create a longer member journey. Finally, those members with a higher balance that have been with the CU for a longer time need to be rewarded and recognized in order to encourage loyalty. The specifics of these measures can be worked out by the marketing team making them relevant for the development of impactful messaging and specific offers.

Having arrived at how to position the loyalty program with members and the segment specific messaging, remember it is important to be consistent across all the channels articulated above.

Put the resources in place to flawlessly execute your strategy

Before implementing your loyalty strategy, it is important to identify the stakeholders responsible for each component of the program. Stakeholders will identify team members and their responsibilities for the implementation of the loyalty program. It is critical that the team work through all departmental interconnections and the requirements for each team member to successfully implement their piece of the program.

There are several core elements that need to be included in a member loyalty campaign. They include:

- Establishing campaign goals. Before beginning any marketing campaign, have a plan. What are the marketing goals and objectives? These should include both marketing and learning goals. By establishing learning goals for campaigns you continually increase your knowledge of the member base and as a consequence increase the CUs overall marketing effectiveness.

- Defining each audience in the member segmentation. The more closely individuals within each specific segment are defined, the better the results.

- Defining the credit union’s USP – Unique Selling Proposition. How does the credit union set itself apart from the crowd? Why should members continue to do business with you instead of switching to a competitor?

- Matching the media to the messaging and member segment. There are a wide variety of social media, including Facebook, Twitter, Pinterest, Tumblr, Instagram, Google + and YouTube. Where are members hanging out online? While it may seem old school, don’t forget traditional media such as radio, television and print. The targeting may not be as exact, but they can be very affordable options when considering how many people these media can reach.

- Including a strong call to action in the creative. A strong call to action provides members an incentive to respond by clearly articulating service benefits. Remember; don’t set unrealistic expectations, traditionally only a small percentage of members who see a campaign will open a new product or service.

Properly positioned and implemented with a longer term perspective, loyalty programs provide credit unions with a win-win scenario. Members benefit by being offered additional products and services, in an educational/needs based manner that are appropriate for them. The credit union benefits from more satisfied members, who not only use more products and services, but become brand advocates promoting the credit union to non-members.