Leveraging use cases to conduct journey mapping

Stella owned a drink cart where she served customers at sporting events. Those were busy days as she stood for long hours in the sun, serving and transacting with people. She sold many types of drinks – cold and hot, alcoholic and non-alcoholic.

She hired Troy to help her create a machine. Troy designed this machine to inquire what drink a person wanted to first determine whether he needed to validate the age of the transactor. He then drew out different scenarios – one person getting one drink, one person getting multiple drinks, multiple people getting multiple drinks with one person paying, etc.

The drink machine was launched with simplified transactions – the customer simply had to push a button. He would list the most popular drinks on the main screen and even allowed the customer to choose a complex drink – mixing soft-drinks, adding alcohol, hot, cold, ice, etc.

Today, their company Stella-n-Troy places drink machines at multiple sporting venues. They have even launched a website which tells consumers about upcoming events and their many specials. In addition to getting served, the transaction begins with a request for a beverage and ends with a receipt being sent digitally to the transactor.

Troy helped by automating the way Stella was serving each customer. He observed each transaction/use case/journey and worked to simplify them. Their journey will continue as their customer needs evolve and they try to grow into other markets.

Cheers! Welcome to use cases and journey mapping. It is about properly understanding the current process/what is being done and trying to enhance experiences to make things better. The process is (and should be) pretty straightforward (and for a very good reason which I will share at the end).

Defining Use Cases

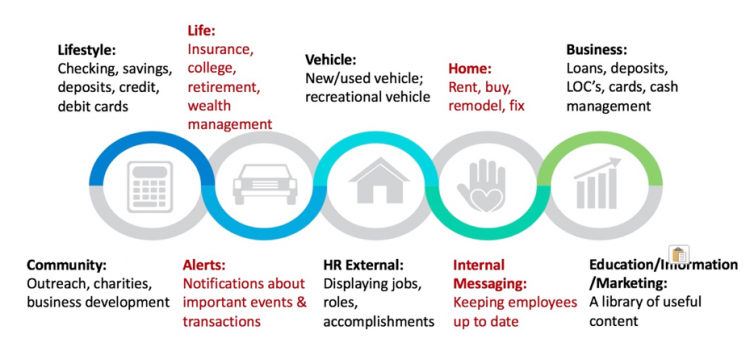

A use case is a way for a financial institution to define a journey with the intent of enhancing a journey. A journey is how the consumer/business interacts with the financial institution. The different offerings from a financial institution can be classified into journey categories. And while there are different ways to classify and sort journeys, here are 10 categories for consideration:

We leverage use cases to identify what needs to be done, to clarify and explain the details, and to organize the information effectively. The consumers/businesses that we serve interact with different platforms/systems that we have. The process of use case discovery also involves the identification of system requirements. Additionally, use cases can be prioritized for execution by defining the expected return on investment for each use case.

The best way to drive improvement is to address deficiencies in the process/journey. We look at these in three phases:

- Identify the current state or how the consumer/business is being served today

- Think about the aspirational state or how the consumer/business needs to be served

- Now identify the gaps so you can address the deficiency between what is desired and what is currently available

As you map your journeys focus on answering the following questions:

- What are we trying to do/solve for?

- Who are we trying to help?

- What is the state of the current process – can it be improved or does it need to be redone?

- What is the desired state?

- What will it take to get there?

When you think about building journeys/writing use cases, think about examples/stories that you can leverage. These anecdotes include the user/business experience/satisfaction, what the competition is doing/offering, what other brands outside our industry are doing to address that particular need.

And most of all, keeping the process straightforward makes it easy to understand and encourages everyone to contribute.

If you want the rest of this article on use cases, simply send me an email to sundeep@digitalcredence.com.