Floating on rising rates to success

As the era of easy money and quantitative easing comes to an end, and with the Federal Reserve embarking on what looks likely to be several rounds of rate increases, depository institutions should be looking to floating-rate loans to help manage interest rate risk. However, before an institution jumps all-in on floating rate loans it is important to establish criteria for comparing these loans against the more common fixed-rate loans originated by many lenders. To that end, this will be the first article in a two-part series discussing floating-rate loans and the means to compare and evaluate them.

Background

Generally, floating-rate loans require a borrower to pay an amount of interest equal to a benchmark rate plus a spread (i.e., a certain amount above the benchmark). Applicable benchmark rates tend to be based upon short-term interest rates, such as the now defunct 1-month LIBOR, and reset as frequently as monthly or as infrequently as annually (longer resets, such as three (3) or five (5) years, are generally considered adjustable-rate loans rather than true floating-rate loans.)

Comparing these loans to fixed-rate loans requires an understanding of the difference between weighted-average life (WAL) and duration.

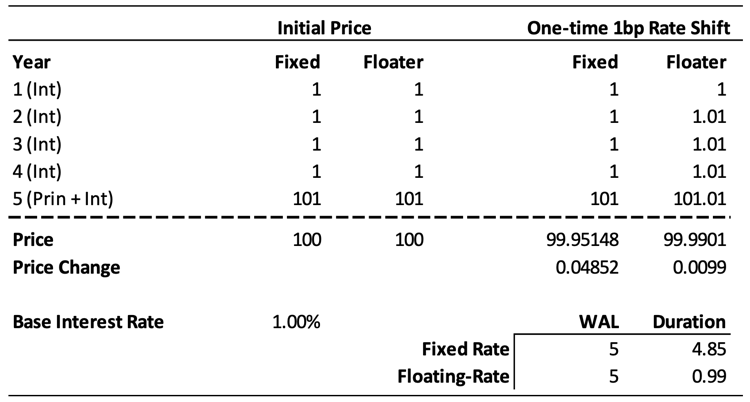

WAL represents the principal-weighted average time until the loan is repaid. For example, fixed-rate automotive loans tend to have a WAL close to 2 to 2.5 years: even though the contract term is likely 5 years or more, the WAL is much shorter owing to these loans’ tendency to return principal in the form of amortization, prepayment and recoveries at a faster rate than the contract term.

Duration is a measure of sensitivity of an asset’s price to interest rates. There are a number of variants for this figure, but the most important one measures the relative change in the price of an asset for a small change in the yield (for those who remember their calculus, this is the derivative of price with respect to yield). For fixed-rate loans, this can be calculated in a similar fashion to the WAL but instead of using principal as the weight, the present-value of the total periodic cashflow is used. In a low interest rate environment, duration and WAL are generally close to one another. This is a result of two factors — first, most of the cashflow being returned is principal; and second, the impact of discounting of the cashflows is small. In contrast, floating-rate loans’ duration and WAL can diverge quite significantly: a floating-rate loan has a duration equal to the time to the next reset period. For example, a floating-rate loan that resets in 1 year would have a 1-year duration, whereas a floating-rate loan that resets in 1 month would have a 1-month duration. Qualitatively, each time the asset resets, it is as if the holder is receiving a new asset whose interest rate is based on the then-existing interest rate environment, thereby limiting the sensitivity to changes in interest rates.

The table below demonstrates the different price sensitivity to a 1 basis point interest-rate change for two $100 loans, both 5-year bullets, paying 1% interest initially, but the first loan is fixed-rate and continues paying 1% when rates change, while the other loan is floating-rate that resets annually.

Evaluating Floating-Rate Loans

There are two primary ways to evaluate floating-rate loans that allow for a more robust comparison with fixed-rated loans. The first compares the floating-rate loans to a more appropriate fixed-rate loan; the second accounts for the interest-rate expectations implied in the yield curve used to set rates for fixed-rate loans. In this article, we will discuss the first approach — leveraging an appropriate fixed rate loan. The next article will discuss the second approach.

The first approach (which is substantially easier to perform) is to select a comparable fixed-rate debt asset against which to benchmark the floating-rate loan. Fixed- and floating-rate debt assets of similar duration should be selected — not similar WAL. Returning to the examples of a floating-rate loan that resets annually, an easily obtainable comparison would be the rate offered for a 1-year Treasury bill. This would be true even if the WAL of the loans were much longer such as 5 years.

While straightforward, there are two main drawbacks to this approach. The first is that, unlike a true short-term loan, a floating-rate loan will not return much of its principal at reset: only periodic amortization and prepayments are paid back prior to maturity. As a result, it does not capture the full liquidity cost to the lender of not being able to redeploy that cash elsewhere. Therefore, an adjustment of some sort for this difference in principal return is required — with the exact amount being left up to the lender with regard to how much to value this feature. The second drawback is that some floating-rate loans have periodic and/or lifetime caps and floors that affect how much the rate on the loan can change at each reset or over the life of the loan. These features tend to extend the duration of the loan but are complicated to evaluate. In general, if the caps and floors are unlikely to occur (i.e., the rates needed to meet those limits are far away), then they have little impact on the duration and a lender should not make a large adjustment for these factors.

Conclusions

Floating-rate loans can be attractive alternatives to fixed-rate loans, particularly for lenders concerned with rising rates, but they require some modifications to the lender’s analysis. It is unfair to compare them to fixed-rate loans with similar weighted-average life, current coupon and purchase price, as this fails to capture the short duration of floating rate loans and the fact that the rate will reset to market rates. Comparing the loans to a more appropriate alternative allows for a better evaluation of the opportunity.

Co-Author: Eric Marcus, Head of Capital Markets