Great expectations

LoanStreet’s capital markets desk manages the pool-building, pricing and execution for billions of dollars of loan participations each year. Over the last several months, the desk has received a number of comments from credit unions looking to deploy cash along the lines of: “The Fed will be raising rates shortly and, therefore, I’ll be able to buy a participation at better yields if I wait.” While we understand the sentiment, in this article, we explain using data why waiting may not be a sound strategy.

When the Fed moves the overnight rate, there’s no assurance that longer-term yields will rise as a result; in fact, the yield curve already reflects the expected path of Fed activity, and it’s only if new information enters into the picture (including “Fedspeak”) that could change the yield curve. To illustrate this point, let us review how longer-term rates moved after each Fed rate announcement this year.

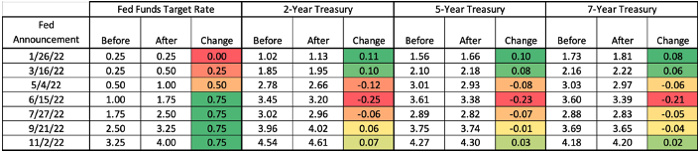

The table below shows 2-Year Treasurys, often the benchmark for auto and unsecured pools, and 5- and 7-Year Treasurys, frequently the benchmarks for longer-term loans, such as residential mortgages and commercial loans, following each Fed rate announcement this year.

As can be seen, in general, when the Fed has raised rates over this past year, longer-term rates have declined rather than risen. While there is a multitude of economic news that typically comes in between meetings that is digested by the market, the actual Fed announcement often leads to a drop in longer-term rates.

Why the disconnect? Why, when the Fed moves its rates, do longer rates not move identically? The answer is: Expectations.

While the Fed manages the short-term Fed Funds Overnight Rate, longer-term rates are all about future rate expectations. In actuality, the Fed sets lower and upper target rates, and using various open-market activities, achieves something usually between the two. Only if and when those expectations have changed would longer-term rates move.

If the Fed did exactly what was expected and no additional news or information came out on that day, longer-term rates would not materially change at all. But the Fed’s actions are not always clear ahead of time. For instance, leading up to the Jun 15, 2022 meeting, expectations were roughly evenly divided between the Fed raising rates 50 or 75 bps, with an average, or expected, increase of 66 bps. When it raised rates 75 bps, the market saw this as a sign that the Fed was being aggressive on squeezing inflation out of the economy quickly and would therefore not need to keep rates higher for longer. So, despite the Fed raising rates more than expected, yields on longer-term Treasurys declined as expectations adjusted.

Another, related, question that comes up is, “With Fed Funds/short-term rates so high, and expected to go higher, aren’t we better off putting our money in short-term investments until the Fed is done and then purchase participations?” The answer is, in general, “No.”

Unless a buyer is making an outright rate call and placing a bet that the yield curve is wrong, rate expectations are such that the putting money to work in short-term assets and later in long-term assets will result in the same return as just putting the money to work now in the longer-term assets since expectations are that yields on the longer-term assets will decline. This was discussed in more detail (and with more math) in our July 2022 white paper, “The Shape of Rates to Come: Yield Curve Expectations and Opportunity Costs.”

In summary, the yield curve at any moment in time incorporates all available information and is a consensus view of future rate expectations. Assuming those expectations are met, nothing is to be gained by waiting for the Fed or any other well-anticipated event to occur. Only surprises and new information change those expectations, and those events can cause rates to move either way; in fact, as of the close on December 1, 2022, the 2-Year Treasury is already almost 50 bps off its highest recent close.

Co-author: Ian Lampl